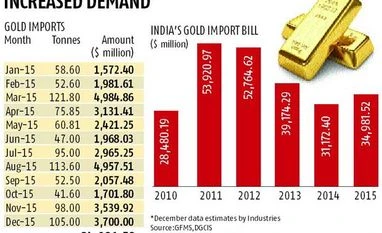

Gold import bill up 12%, reaches $35 bn in 2015

India's imports of gold crossed 100 tonnes in December alone, gross official import crossed 900 tonnes

)

India’s gold import in December 2015 is estimated to have crossed 100 tonnes following sharp increase in demand for the precious metal during the first and the last week of the month when prices fell sharply world over.

With 105 tonnes of estimated imports in December, total gross import in 2015 crossed 900 tonnes which was 25 per cent more than 2014. In terms of value, it was up about 12 per cent at around $35 billion, as December import bill was around $3.7 billion. India imported $31.17 billion worth gold in 2014.

Sudheesh Nambiath, lead analyst, GFMS Thomson Reuters said, “Gold demand increased in December when prices were at the lowest level in 2015, and as retailers increased their inventory to optimum levels. Our estimate for December import is 107 tonnes.” In 2015, just over 700 tonnes gold was net import as rest was duty-free imports for re-export after value addition.

Despite sharp spurt in quantity imported, import bill went up by only 12 per cent because of low prices in international market. Average international gold price fell by 8 per cent in 2015 while the price oscillated in a $246 range. In other words, gold prices in international market fell by nearly 20% from the annual high. The import bill low also because more imports took place when prices fell below $1,100 per ounce.

On the other hand, significant increase in import of unrefined or dore gold happened at a premium pricing, which at times was a percentage over the LBMA price. Its share in total supply increased from some 15% to 30% in 2015. Mostly dore is imported at a premium over the LBMA gold PM price because of heavy competition at sourcing, given the 2 per cent differential that refiners in excise-free zone enjoy. Dore gold import in net gold purity terms was more than 200 tonnes as per estimates of GFMS Thomson Reuters.

Gold import in November was 98 tonnes. In March and August 2015, gold import had crossed 100 tonnes mark as prices were lower, according to GFMS.

Gold demand in the last two weeks has again remained subdued because of traditional belief that this period is inauspicious to buy precious metal. A bullion dealer said, “Indian demand for gold may or may not increase even when prices are around bottom but they take inauspicious days seriously.”

During 2015, there were apprehensions about gold demand from rural sector because agriculture output was impacted due to poor rains. However, according to Nambiath, “Pent up demand at lower price levels and expectation for further weakening of Indian rupee added to the gains.”

With 105 tonnes of estimated imports in December, total gross import in 2015 crossed 900 tonnes which was 25 per cent more than 2014. In terms of value, it was up about 12 per cent at around $35 billion, as December import bill was around $3.7 billion. India imported $31.17 billion worth gold in 2014.

Sudheesh Nambiath, lead analyst, GFMS Thomson Reuters said, “Gold demand increased in December when prices were at the lowest level in 2015, and as retailers increased their inventory to optimum levels. Our estimate for December import is 107 tonnes.” In 2015, just over 700 tonnes gold was net import as rest was duty-free imports for re-export after value addition.

Despite sharp spurt in quantity imported, import bill went up by only 12 per cent because of low prices in international market. Average international gold price fell by 8 per cent in 2015 while the price oscillated in a $246 range. In other words, gold prices in international market fell by nearly 20% from the annual high. The import bill low also because more imports took place when prices fell below $1,100 per ounce.

On the other hand, significant increase in import of unrefined or dore gold happened at a premium pricing, which at times was a percentage over the LBMA price. Its share in total supply increased from some 15% to 30% in 2015. Mostly dore is imported at a premium over the LBMA gold PM price because of heavy competition at sourcing, given the 2 per cent differential that refiners in excise-free zone enjoy. Dore gold import in net gold purity terms was more than 200 tonnes as per estimates of GFMS Thomson Reuters.

Gold import in November was 98 tonnes. In March and August 2015, gold import had crossed 100 tonnes mark as prices were lower, according to GFMS.

During 2015, there were apprehensions about gold demand from rural sector because agriculture output was impacted due to poor rains. However, according to Nambiath, “Pent up demand at lower price levels and expectation for further weakening of Indian rupee added to the gains.”

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 16 2016 | 11:27 PM IST