Axis Bank: Highly leveraged to economic recovery, reforms

2014's top performer in the Nifty universe may post better loan growth and stable margins, say observers

)

Axis Bank’s scrip was the top performer in 2014 in the CNX-Nifty (benchmark index on the National Stock Exchange) universe. It grew almost 100 per cent in the calendar year.

The stock was under pressure at the beginning of the year, due to concerns on asset quality, since its exposure to the troubled infrastructure sector and to highly leveraged companies was on the higher side, compared to other private banks. This, with high interest rates and a slowing economy, weighed on the stock, which fell 4.2 per cent in 2013.

Formation of a stable government at the Centre, starting of coal and power sector reforms and Axis’ sustained show on asset quality were key catalysts for the stock, which started gaining traction in March 2014 and has not looked back. Infrastructure and the small and medium enterprises (SME) sector form about a fourth of Axis’ loans and stand to gain from potential reforms, as well as economic revival. Some brokerages, such as Macquarie, even have Axis among their top large-cap picks for 2015.

“Axis Bank is well-leveraged to the corporate cycle recovery, due to its large infrastructure and SME exposure. The bank is well-capitalised, with a tier-I capital adequacy ratio of 12-plus per cent. So, there is very little risk of equity dilution over the next two years and Axis can capitalise on growth opportunities”, says Rakesh Arora, head of research, Macquarie Capital.The stock was under pressure at the beginning of the year, due to concerns on asset quality, since its exposure to the troubled infrastructure sector and to highly leveraged companies was on the higher side, compared to other private banks. This, with high interest rates and a slowing economy, weighed on the stock, which fell 4.2 per cent in 2013.

Formation of a stable government at the Centre, starting of coal and power sector reforms and Axis’ sustained show on asset quality were key catalysts for the stock, which started gaining traction in March 2014 and has not looked back. Infrastructure and the small and medium enterprises (SME) sector form about a fourth of Axis’ loans and stand to gain from potential reforms, as well as economic revival. Some brokerages, such as Macquarie, even have Axis among their top large-cap picks for 2015.

Despite the high risk, Axis has done well to keep both gross and net non-performing asset (NPA) ratios in a tight range of 1.2-1.3 per cent and 0.4-0.44 per cent, respectively, in the past five quarters. Its margins, too, have remained stable in this period, due to an increased focus on the retail segment and a stronger liability franchise. While low-cost retail deposits and current and savings accounts together form 75 per cent of its total deposits, the retail contribution to total loans has gone up from 20 per cent two years earlier to the current 31 per cent.

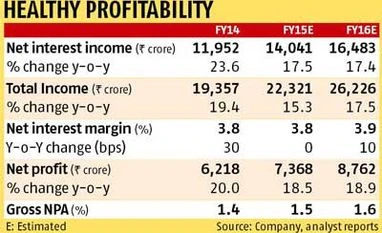

Loan growth is expected to improve from 17 per cent in FY14 to 18 per cent this financial year and 20 per cent in FY16, with continued traction in the retail segment and likely pick-up in project loans. In this backdrop, most analysts remain positive on Axis. At Wednesday’s closing price, the stock trades at 2.4 times the FY16 estimated book value, closer to its historical average of the one-year forward price to book value ratio of two times.

“We believe Axis is well poised for robust growth, on the back of its franchise strength. The retail business continues to provide adequate earnings support, along with lower concern on asset quality, a key positive,” says Divyanshi Dayanand of SBICap Securities. Higher than expected asset quality pressure is a key downside risk.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 01 2015 | 10:46 PM IST