Diamond price & demand trend worries processors

Surge in import of polished stones as jewellery makers battle higher costs of credit and labour, even as prices of rough diamonds rise

)

Faced with a squeeze on margins between the prices of rough and polished diamonds, Indian diamantaires are importing far more of the latter, pushing the domestic processing industry into a spot.

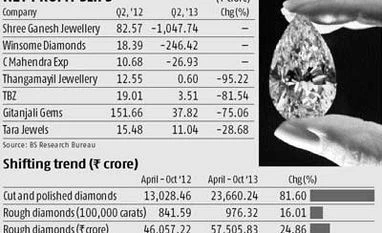

Data from the Gems & Jewellery Export Promotion Council (GJEPC) show import of roughs rose 24.9 per cent to Rs 57,506 crore in April–October as compared to Rs 46,057 crore in the corresponding period last year. In volume terms, however, import of roughs grew only 16 per cent, to 97.632 million carats in these first seven months of the financial year, from 84.159 million carats in the comparable period last year.

By contrast, import of cut and polished (C&P) diamonds jumped 81.6 per cent to Rs 23,660 crore in the period, as compared to Rs 13,028 crore in the same period of 2012-13. Most of this surge was attributed to the growth of imports in Special Economic Zones (SEZs), where the import duty is nil as against the two per cent levied on polished diamonds and 15 per cent on finished jewellery in the Domestic Tariff Area (DTA).

“Ornaments manufactured in DTA may also be supplied to the domestic market. But, jewellery made in SEZs with imported raw materials is purely meant for export. Hence the duty differential, because of variation in jewellery treatment,” said Vipul Shah, chairman of GJEPC.

Recently, GJEPC asked the Union ministry of commerce to revoke trading licences in SEZs. Rising import of C&P diamonds has threatened many large companies in this segment. Their profitability sharply declined in the quarter ending September 30. For instance, Kolkata-based Shree Ganesh Jewellery House recorded a net loss of Rs 1,048 crore for the quarter, compared to an Rs 82.6 crore net profit in the corresponding period last year. Similarly, against a Rs 151.7 crore net profit in the quarter in 2012-13, Gitanjali Gems posted a decline of 75 per cent in profitability, to Rs 37.8 crore.

Tara Jewels and Rajesh Exports also reported a decline in net profit, to Rs 11 crore and Rs 100 crore against one of Rs 15.5 crore and Rs 112.5 crore, respectively.

“Profitability of jewellery manufacturers is under severe squeeze due to high interest on working capital loans, coupled with a staggering growth in labour cost. While the cost of borrowing for jewellery manufacturers has gone up to 12 per cent now from six per cent a few quarters earlier, labour cost has jumped at least by 20 per cent in the period. Unavailability of gold loans is another issue the industry has been facing since its ban,” said Umesh Parekh, managing director of Shree Ganesh.

People in the sector here have also urged De Beers, the world’s largest rough diamond supplier, to align these prices to those of C&Ps. Owing to weak global demand, prices of the latter have been almost steady in the past two months, while prices of roughs continued to surge. A meeting last week with officials of De Beers had people from here emphasising the need to discourage speculation in the market. However, De Beers has refused to align the prices, saying these were determined by market forces.

Jewellery exporters are hopeful of a revival in demand with the coming festive season abroad — Christmas, New Year and Mother’s Day.

Data from the Gems & Jewellery Export Promotion Council (GJEPC) show import of roughs rose 24.9 per cent to Rs 57,506 crore in April–October as compared to Rs 46,057 crore in the corresponding period last year. In volume terms, however, import of roughs grew only 16 per cent, to 97.632 million carats in these first seven months of the financial year, from 84.159 million carats in the comparable period last year.

By contrast, import of cut and polished (C&P) diamonds jumped 81.6 per cent to Rs 23,660 crore in the period, as compared to Rs 13,028 crore in the same period of 2012-13. Most of this surge was attributed to the growth of imports in Special Economic Zones (SEZs), where the import duty is nil as against the two per cent levied on polished diamonds and 15 per cent on finished jewellery in the Domestic Tariff Area (DTA).

“Ornaments manufactured in DTA may also be supplied to the domestic market. But, jewellery made in SEZs with imported raw materials is purely meant for export. Hence the duty differential, because of variation in jewellery treatment,” said Vipul Shah, chairman of GJEPC.

Recently, GJEPC asked the Union ministry of commerce to revoke trading licences in SEZs. Rising import of C&P diamonds has threatened many large companies in this segment. Their profitability sharply declined in the quarter ending September 30. For instance, Kolkata-based Shree Ganesh Jewellery House recorded a net loss of Rs 1,048 crore for the quarter, compared to an Rs 82.6 crore net profit in the corresponding period last year. Similarly, against a Rs 151.7 crore net profit in the quarter in 2012-13, Gitanjali Gems posted a decline of 75 per cent in profitability, to Rs 37.8 crore.

“Profitability of jewellery manufacturers is under severe squeeze due to high interest on working capital loans, coupled with a staggering growth in labour cost. While the cost of borrowing for jewellery manufacturers has gone up to 12 per cent now from six per cent a few quarters earlier, labour cost has jumped at least by 20 per cent in the period. Unavailability of gold loans is another issue the industry has been facing since its ban,” said Umesh Parekh, managing director of Shree Ganesh.

People in the sector here have also urged De Beers, the world’s largest rough diamond supplier, to align these prices to those of C&Ps. Owing to weak global demand, prices of the latter have been almost steady in the past two months, while prices of roughs continued to surge. A meeting last week with officials of De Beers had people from here emphasising the need to discourage speculation in the market. However, De Beers has refused to align the prices, saying these were determined by market forces.

Jewellery exporters are hopeful of a revival in demand with the coming festive season abroad — Christmas, New Year and Mother’s Day.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 11 2013 | 10:35 PM IST