Aluminium producers to raise product prices soon

Doubling of clean energy cess to further squeeze margins of domestic aluminium companies

)

With the government proposing to hike the customs duty on primary aluminium products, domestic majors like Aditya Birla Group company Hindalco Industries, state-owned National Aluminium Company (Nalco) and Anil Agarwal-led Vedanta are planning to raise product prices in coming months.

“Since pricing happens on import parity, we certainly have the room now to raise product prices by about Rs 2,500 per tonne,” a Nalco official said. “This hike will happen in phases in coming months.” In the Budget, Finance Minister Arun Jaitley has proposed to increase the customs duty on primary aluminium to 7.5 per cent from five per cent at present. Global prices of aluminium and movement of rupee will also be taken into consideration at the time of price revision.

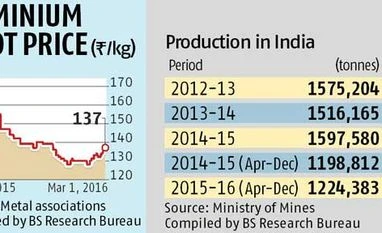

Global aluminium prices are currently around $1,600 a tonne, while the rupee against the dollar has been showing a weakening trend.

Though aluminium companies could see their realisations, in terms of value, improve due to a better pricing scenario, sales volumes are not expected to rise significantly.

“Nearly 70 per cent of the imported primary aluminium is brought on duty-free advance licence. Due to this, it does not compete with domestic producers and, hence, not much will change for us (domestic producers) in terms of volumes at the topline,” the Nalco official explained.

Importers that bring aluminium under the duty-free advance licence export the product, thereby not hurting the domestic consumption-supply pattern. Typically, an import duty hike will narrow the price gap between landed cost and domestically produced aluminium, curbing aluminium imports. Currently, the price gap between domestically produced and cheap imported aluminium is at about Rs 5,000 per tonne, significantly lower than the wide gap of Rs 20,000 per tonne in 2014.

“Since imported aluminium would continue to be slightly cheaper than domestically produced metal after the duty, there will be no shift or higher demand for domestically produced aluminium from importers bringing metal on advance licence,” said the Nalco official.

The good news (import duty hike) for the domestic aluminium, however, ends right there as doubling of the Clean Environment Cess on coal, lignite and peat will not just nullify the benefit of customs duty hike but is also likely to hurt companies’ margins in coming quarters. The government has doubled the Clean Environment Cess to Rs 400 per tonne from Rs 200 per tonne, pushing up production cost.

Aluminium manufacturers’ power cost is expected to rise by three per cent because of doubling of Clean Environment Cess, said the CRISIL Research.

“The impact of cess levied is going to be stronger at about Rs 3,000 per tonne of metal production than the benefit (of about Rs 2,500 per tonne) from the import duty. Due to this, our margins are going to come under further pressure in coming quarters,” said an official with Hindalco Industries, the country’s largest producer.

Hindalco Industries’ profit before interest and tax for its aluminium business has dropped by 26 per cent from FY12 to Rs 1,349 crore in FY15. In case of other aluminium producers, NALCO has been diversifying its topline in order to insulate itself from the bad weather it has been already facing in the aluminium business. Vedanta’s aluminium business on the other hand is already making miniscule contributions to the consolidated earnings.

“Since power cost accounts for a significant share of the overall cost of production for non-ferrous metals, increase in the cost of coal used by captive power plants on account of increase in freight rate and Clean Environment Cess is likely to increase the cost of production of these players,” said Care Ratings in its report.

“Since pricing happens on import parity, we certainly have the room now to raise product prices by about Rs 2,500 per tonne,” a Nalco official said. “This hike will happen in phases in coming months.” In the Budget, Finance Minister Arun Jaitley has proposed to increase the customs duty on primary aluminium to 7.5 per cent from five per cent at present. Global prices of aluminium and movement of rupee will also be taken into consideration at the time of price revision.

Global aluminium prices are currently around $1,600 a tonne, while the rupee against the dollar has been showing a weakening trend.

Though aluminium companies could see their realisations, in terms of value, improve due to a better pricing scenario, sales volumes are not expected to rise significantly.

“Nearly 70 per cent of the imported primary aluminium is brought on duty-free advance licence. Due to this, it does not compete with domestic producers and, hence, not much will change for us (domestic producers) in terms of volumes at the topline,” the Nalco official explained.

“Since imported aluminium would continue to be slightly cheaper than domestically produced metal after the duty, there will be no shift or higher demand for domestically produced aluminium from importers bringing metal on advance licence,” said the Nalco official.

The good news (import duty hike) for the domestic aluminium, however, ends right there as doubling of the Clean Environment Cess on coal, lignite and peat will not just nullify the benefit of customs duty hike but is also likely to hurt companies’ margins in coming quarters. The government has doubled the Clean Environment Cess to Rs 400 per tonne from Rs 200 per tonne, pushing up production cost.

Aluminium manufacturers’ power cost is expected to rise by three per cent because of doubling of Clean Environment Cess, said the CRISIL Research.

“The impact of cess levied is going to be stronger at about Rs 3,000 per tonne of metal production than the benefit (of about Rs 2,500 per tonne) from the import duty. Due to this, our margins are going to come under further pressure in coming quarters,” said an official with Hindalco Industries, the country’s largest producer.

Hindalco Industries’ profit before interest and tax for its aluminium business has dropped by 26 per cent from FY12 to Rs 1,349 crore in FY15. In case of other aluminium producers, NALCO has been diversifying its topline in order to insulate itself from the bad weather it has been already facing in the aluminium business. Vedanta’s aluminium business on the other hand is already making miniscule contributions to the consolidated earnings.

“Since power cost accounts for a significant share of the overall cost of production for non-ferrous metals, increase in the cost of coal used by captive power plants on account of increase in freight rate and Clean Environment Cess is likely to increase the cost of production of these players,” said Care Ratings in its report.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 01 2016 | 10:35 PM IST