PE exits in real estate rose by 33% in 2013

Investments were down by 8.2% in the year

)

Private equity (PE) firms focused on the real estate sector made 24 exits during 2013 compared to a total of 18 exits announced during 2012. Ten of these exits with disclosed values harvested $421 million for the investors.

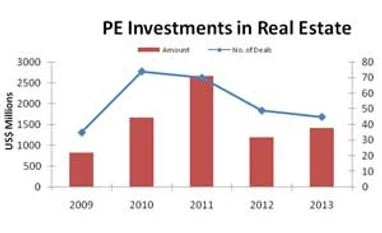

As far as investment is concerned, private equity-real estate firms made 45 investments during 2013. Of these, 37 transactions had an announced value of $1,423 million. The activity level was 8.2% lower compared to the 49 investments ($1,202 million across 39 announced deals) in 2012.

The buyback route – acquisition of the PE firm’s interest by the developer - accounted for 23 of the exits, according to Chennai-based Venture Intelligence, a research service focused on private company financials, transactions and valuations.

Landmark Holdings exited Wave Hi-Tech City, a township in Ghaziabad run by the Wave Group, with Rs 350 crore, at an internal rate of return (IRR) of 20%. In the only exit outside of buybacks, Shriram Properties purchased a 12.5-acre land parcel valued at over Rs 110 crore along Bangalore's IT corridor of Sarjapur Road from Golden Gate Properties.

The transaction gave Citi an exit from its five-year-old investment in which it committed approximately Rs 150 crore as quasi debt.

Investments down by 8.2%

Private equity-real estate firms made 45 investments in the segment during 2013. Of these, 37 transactions had an announced value of $1,423 million. The activity level was 8.2% lower compared to the 49 investments ($1,202 million across 39 announced deals) in 2012.

The largest investment announced during

2013 was Blackstone and HDFC Venture’s $367 million acquisition of Vrindavan Tech Village, along with Embassy Group, from Singapore-based Assetz Property Group. This was followed by Canada Pension Plan Investment Board’s (CPPIB) commitment of $200 million for an 80-20 joint venture with Shapoorji Pallonji Group that will target office assets in Indian metros; Ascendas Trust's Rs 600 crore (about $110 million) acquisition of 2 million sq ft of office space in Hyderabad from Phoenix Group; and StanChart’s joint venture with publicly listed Mahindra Lifespaces to together invest Rs 1,000 crore across various projects.

Residential projects accounted for 46.7% of the investments by volume (and 66.7% including townships) during 2013, followed by commercial projects with a 16% share of the pie, the Venture Intelligence research added.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 09 2014 | 10:15 AM IST