More pain ahead for State Bank of India

Better placed than public-sector peers, but asset problems will haunt for a quarter or two

)

Higher provisioning hit State Bank of India (SBI)'s net profit for the quarter ended December. SBI's provisions for non-performing assets (NPAs) soared 59 per cent year-on-year, y-o-y, (and doubled sequentially) to Rs 7,645 crore in the December quarter. This, along with a sharp rise in tax rate, led to a 61.7 per cent y-o-y fall in net profit to Rs 1,115 crore, which is about a third of Bloomberg consensus estimate of Rs 3,300 crore.

Worse, SBI's gross NPAs (slippages) increased Rs 20,692 crore in the quarter, of which about Rs 15,000 crore was due to the RBI directing banks to review their asset quality. While a similar amount (Rs 15,000 crore) is likely in the March quarter, SBI's chairman said some of it may spill over to financial year 2017. This may not be as high as seen in the December quarter. Both gross and net NPAs were at their highest levels in at least seven quarters.

Many analysts believe a large part of the pain will be over in the March quarter, after which addition to bad loans will moderate. However, given SBI's exposure to power, steel, and other stressed sectors, and the shape of domestic and global economies, it may be a bit early to predict.

Other areas merit attention. December quarter profits were supported by a 37 per cent y-o-y surge in non-core, unsustainable incomes, such as profit on sale of investment, foreign exchange, and miscellaneous income, at Rs 2,667 crore, whereas fee income grew 6.6 per cent to Rs 3,509 crore. The yield on advances have been falling at a faster pace than decline in cost of deposits, thus net interest margins at 2.93 per cent were also at the lowest in five quarters.

However, there are some improvements. Higher provisioning led to reversal in interest income, resulting in a 1.2 per cent fall in net interest income to Rs 13,606 crore, excluding which the figure would have been better. Notably, SBI's loans grew 12.9 per cent in the quarter — it's highest in the past five quarters. Healthy traction in large corporate, retail, and international loans fuelled this growth. The bank's effort in increasing lending to higher-rated corporate groups (A and above) continues to yield results.

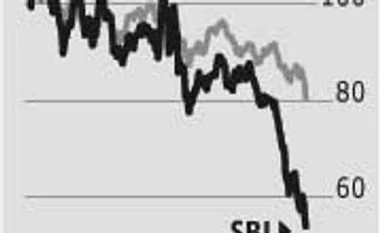

Following the weak results, the stock made a new 52-week low of Rs 152 on Thursday before closing three per cent lower at Rs 154, where it trades at only 0.6 times FY17 estimated book on a consolidated basis. While the valuation looks inexpensive, most analysts could trim their full-year estimates, which may keep the stock in check.

Worse, SBI's gross NPAs (slippages) increased Rs 20,692 crore in the quarter, of which about Rs 15,000 crore was due to the RBI directing banks to review their asset quality. While a similar amount (Rs 15,000 crore) is likely in the March quarter, SBI's chairman said some of it may spill over to financial year 2017. This may not be as high as seen in the December quarter. Both gross and net NPAs were at their highest levels in at least seven quarters.

Other areas merit attention. December quarter profits were supported by a 37 per cent y-o-y surge in non-core, unsustainable incomes, such as profit on sale of investment, foreign exchange, and miscellaneous income, at Rs 2,667 crore, whereas fee income grew 6.6 per cent to Rs 3,509 crore. The yield on advances have been falling at a faster pace than decline in cost of deposits, thus net interest margins at 2.93 per cent were also at the lowest in five quarters.

However, there are some improvements. Higher provisioning led to reversal in interest income, resulting in a 1.2 per cent fall in net interest income to Rs 13,606 crore, excluding which the figure would have been better. Notably, SBI's loans grew 12.9 per cent in the quarter — it's highest in the past five quarters. Healthy traction in large corporate, retail, and international loans fuelled this growth. The bank's effort in increasing lending to higher-rated corporate groups (A and above) continues to yield results.

Following the weak results, the stock made a new 52-week low of Rs 152 on Thursday before closing three per cent lower at Rs 154, where it trades at only 0.6 times FY17 estimated book on a consolidated basis. While the valuation looks inexpensive, most analysts could trim their full-year estimates, which may keep the stock in check.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 11 2016 | 10:22 PM IST