Fiscal deficit reaches 83% of budget estimates in H1 FY15

Budget had estimated fiscal deficit to be Rs 5.31 lakh crore or 4.1% of GDP

)

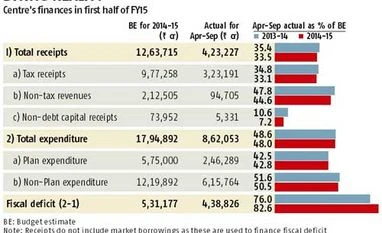

A day after the government announced austerity measures on the non-Plan expenditure side, official data on Friday showed the Centre’s fiscal deficit has surged to 82.6 per cent of the Budget Estimate (BE) in the first half of the current financial year, against 76 per cent in the corresponding period of the previous financial year.

Data showed the government failed to mop up as much revenue as was planned at the time of the Budget, though it successfully reined in expenditure. The government attributed the trend to high refunds, admitting that indirect tax collection target is a challenge though direct tax mop-up pegged in BE would be met.

The Budget had estimated fiscal deficit to be Rs 5.31 lakh crore or 4.1 per cent of GDP (gross domestic product) in 2014-15. However, it stood at around Rs 4.39 lakh crore in April-September period.

The deficit had stood at 76 per cent of BE in the year-ago period, even then the government was able to rein it in much below than the target of 4.8 per cent of GDP at around 4.5 per cent. But, for that plan expenditure was pruned by over 18 per cent or over Rs 1 lakh crore.

The target this year stands at controlling fiscal deficit at 4.1 per cent of GDP, which seems a far cry at least now.

Total receipts stood at Rs 4.23 lakh crore, constituting 33.1 per cent of BE at around Rs 12.64 lakh crore. At this point, revenues (as portion of BE) were bit higher at 35.4 per cent in FY14.

All segments of receipts — tax, non-tax, non-debt capital — were lower as proportion of BE in the first half of the current financial year than the corresponding period of the previous year.

Tax receipts stood at around Rs 3.23 lakh crore, accounting for 33.1 per cent of BE at approximately Rs 9.77 lakh crore against 34.8 per cent a year ago.

Finance Minister Arun Jaitley told reporters, “We will be very close to achieving FY15 direct tax target, but indirect tax could be a challenge.”

He said fiscal deficit is showing an upward trend because of high tax refund. As much as Rs 1.20 lakh crore of refunds were given on both direct and indirect taxes, he revealed.

The second set of advance payments fall due on September 15 and in that respect lower tax mop-up could be a cause of concern.

Non-tax revenues at around Rs 95,000 crore constituted 45 per cent of the target at Rs 2.12 lakh crore against around 48 per cent in a year-ago period.

Non-debt capital receipts were just over Rs 5,000 crore, meeting just over seven per cent of BE at Rs 74,000 crore. At this point of time, these funds constituted over 10 per cent of BE in the previous financial year. Most of these funds at over Rs 58,000 crore are to come from various direct and indirect disinvestments, none of which has materialised so far.

“With tax revenue growth under-performing, the budgeted target in the first half of FY15, revenue buoyancy will crucially hinge upon the success of the telecom auction and disinvestment offerings in the remainder of this financial year,” said Aditi Nayar, senior economist with ICRA.

On the other hand, expenditure was managed better and contained at Rs 8.62 lakh crore, which meant 48 per cent of BE at around Rs 17.95 lakh crore. At this point of time, expenditure stood at 48.6 per cent of BE.

While plan expenditure was a bit higher (around Rs 2.46 lakh crore) at 42.8 per cent of BE (Rs 5.75 lakh crore) against 42.5 per cent in the first half of 2013-14, non-plan expenditure was bit lower (around Rs 6.16 lakh crore) at 50.5 per cent of BE (around Rs 12.20 lakh crore) against 51.6 per cent.

On Thursday, the government had announced 10 per cent cut in non-plan expenditure, a practice being followed since global financial crisis erupted in 2008-09.

“In addition to the measures, savings related to the budgetary allocation for food subsidy and fuel subsidies would ease the pressure on non-Plan revenue expenditure side in the second half,” Nayar said.

She said even as fiscal deficit reached nearly 83 per cent of BE in the first half, a sharp slippage relative to the target of 4.1 per cent of GDP is unlikely in 2014-15. If the government manages to rein in fiscal deficit even at 4.2 per cent of GDP, it would meet the fiscal consolidation target, through it would slightly breach the BE.

Revenue deficit, which many analysts give much more importance than fiscal deficit as this part of excess expenditure does not create assets, stood at 91.2 per cent of BE against around 85 per cent in the first half of 2013-14.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 01 2014 | 12:40 AM IST