Is inflationary pressure back?

)

India's official inflation data (WPI) for July 2013 showed a trajectory that was in contrast to the retail inflation data (CPI). While CPI eased a tad in July (to 9.64 per cent, down from 9.87 per cent in June), the WPI jumped by nearly one per cent (from 4.86 per cent in June to 5.79 per cent in July), clearly indicating that the inflationary pressures persist.

Not surprisingly, high and rising food inflation perked up the overall inflation. With food inflation rising to 11.91 per cent (the highest since February 2013), it added 37.8 per cent to the headline inflation, led by sky rocketing vegetable prices, which rose 46.59 per cent in July.

Within vegetables, onion prices have been witnessing a sharp rise over the past six months, with prices going up by nearly 123 per cent annualised rate every month. While this is attributed to the hoarders playing havoc with the supply chain, this does have ominous portent. The general expectation of analysts across the board is that food inflation will ease soon, as India is scheduled to have a normal monsoon this year.

However, a normal monsoon is more a statistical phenomenon and it is quite possible that parts of India may experience flood while other parts may experience drought and yet India will still have a normal monsoon on an average.

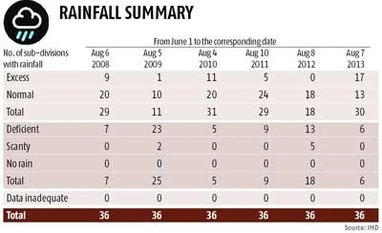

As of now, several states in India has experienced flood. Rainfall has been normal only in 13 of the 36 regions while it was excess in 17 states. According to IMD, there's a 15 per cent deviation from the normal at the all-India level till date, while any deviation above 20 per cent is considered excess.

With flood likely to impact agriculture production in the affected states, expectation of substantial easing of food inflation may not materialise going forward. And, with the government failing to check the menace of hoarding time and again, there is every possibility of an abnormal spike in prices for the affected products.

Also, while core inflation continues to be low and within RBI's comfort level, there's some sign of price pressure coming back. While overall demand is pretty weak, rural demand still remains robust, as is evidenced from the general performance of FMCG companies and the generally rising trend in production of non-durable goods. Core inflation moved up from 2.02 per cent in June to 2.35 per cent in July, after having declined continuously since August 2012.

As the weak rupee weighs in on the input costs, further price pressure is inevitable, despite poor overall demand. One may, therefore, need to brace for gradually inching inflation.

The author is a Delhi-based independent economist

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 15 2013 | 3:22 AM IST