Copper to remain subdued on rising production, falling demand

LME inventories on the rise since last fall of almost 200,000 tonnes last year

)

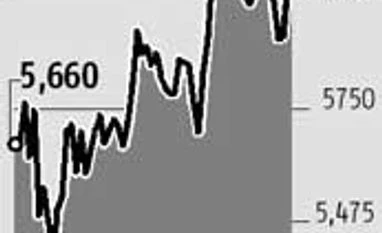

Copper prices are likely to remain subdued this year on rising production and falling demand from consumer industries, due to economic uncertainty across the world. The price decline has been 20 per cent since January 2014, to trade currently at $6,150 a tonne on the benchmark London Metal Exchange (LME).

“We do not expect a pick-up in prices of note until the latter half of 2015. We expect copper to average $5,975/tonne in 2015, a 12 per cent drop from the previous year. Copper continues to be pulled by the standoff between the bulls and the bears, which essentially represent opposing positions on what the inventory surge tells us and how long it will run,” said global consultancy firm Thomson Reuters GFMS in its latest report.

LME inventories, though still low, have been on the rise after falling almost 200,000 tonnes last year. Shanghai Futures Exchange stocks are also generally climbing and the rise in visible inventories is playing to all the bears’ arguments for further price weakness.

There are some seasonality factors in stock building. Expectations of lower prices are influencing buyer activity. Also, more metal flows into exchange warehouses due to reduction in financing for stocks as an effect of last year’s Qingdao port scandal.

“The price is set to remain under pressure as the new mine supply will exceed the rate of consumption by about 1.5 per cent per annum. A majority of the new mine supply is expected to come from Peru, Chile, Zambia, Panama and Mongolia. Also, copper demand seems to trend down to a modest annual average growth rate of five to six per cent in three to five years,” said Mahaveer Jain, an analyst with India Ratings & Research.

International Copper Study Group expects the overall refined metal supply to grow at 4.3 per cent year on year (yoy), as opposed to the consumption growth rate of 1.1 per cent yoy in 2015. The metal’s demand in India is expected to grow modestly this year from key sectors. Copper mine output is expected to rise three per cent this year to about 19 million tonnes, from an estimated 18.3 mt in 2014.

Refined output also looks set for another year of fairly strong growth, despite some constraints on secondary supply.

“The risk of mine closures looks limited. Industry average net cash costs declined intra-year by 11 per cent. Longer term prospects arguably look disconcerting for supply growth. We calculate the incentive price for new production at $7,703/tonne, and with spot prices below these levels for two years, project deferrals, mothballing and re-scoping should hold back future growth levels in mine supply, ensuring today’s feast turns to famine,” said the study.

Led by four per cent growth in China, down from six per cent last year, overall global copper demand is forecast to increase by three per cent in 2015 to approach 22.2 mt.

With rising production and softer demand growth, the market is likely to record a 399,000 tonne surplus this year as against one of 316,000 tonnes last year.

“We do not expect a pick-up in prices of note until the latter half of 2015. We expect copper to average $5,975/tonne in 2015, a 12 per cent drop from the previous year. Copper continues to be pulled by the standoff between the bulls and the bears, which essentially represent opposing positions on what the inventory surge tells us and how long it will run,” said global consultancy firm Thomson Reuters GFMS in its latest report.

LME inventories, though still low, have been on the rise after falling almost 200,000 tonnes last year. Shanghai Futures Exchange stocks are also generally climbing and the rise in visible inventories is playing to all the bears’ arguments for further price weakness.

There are some seasonality factors in stock building. Expectations of lower prices are influencing buyer activity. Also, more metal flows into exchange warehouses due to reduction in financing for stocks as an effect of last year’s Qingdao port scandal.

“The price is set to remain under pressure as the new mine supply will exceed the rate of consumption by about 1.5 per cent per annum. A majority of the new mine supply is expected to come from Peru, Chile, Zambia, Panama and Mongolia. Also, copper demand seems to trend down to a modest annual average growth rate of five to six per cent in three to five years,” said Mahaveer Jain, an analyst with India Ratings & Research.

Refined output also looks set for another year of fairly strong growth, despite some constraints on secondary supply.

“The risk of mine closures looks limited. Industry average net cash costs declined intra-year by 11 per cent. Longer term prospects arguably look disconcerting for supply growth. We calculate the incentive price for new production at $7,703/tonne, and with spot prices below these levels for two years, project deferrals, mothballing and re-scoping should hold back future growth levels in mine supply, ensuring today’s feast turns to famine,” said the study.

Led by four per cent growth in China, down from six per cent last year, overall global copper demand is forecast to increase by three per cent in 2015 to approach 22.2 mt.

With rising production and softer demand growth, the market is likely to record a 399,000 tonne surplus this year as against one of 316,000 tonnes last year.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 17 2015 | 10:25 PM IST