Religare to focus on lending, health insurance

Shares have shed over 20% after sales of life insurance, MF began in May; all decisions well thought through, says CMD

)

In an investor presentation following its second quarter results, published on the exchanges on November 2, Religare Enterprises listed the strategic priority for its asset management joint venture, Religare Invesco, as “profitable AUM (assets under management) growth”.

This view was largely in line with the positive outlook spelt out in the annual report, a few months earlier. However, less than three weeks later, Religare surprised its shareholders by saying it was exiting the joint venture (JV), which had an AUM of Rs 21,593 crore, selling out to minority partner Invesco.

Soon after, Religare executives were quoted as saying there was a call option in the JV agreement, available till March 2016, exercised by Atlanta-based Invesco. In an e-mail interview, Sunil Godhwani, chairman and managing director at Religare Enterprises, added: “This announcement was a planned and scheduled one and shouldn’t be viewed as something decided now. It had always been a part of our operating blueprint.”

Existence of the call option was another surprise for investors, who had never heard of this from the JV which was formed in 2012, either in exchange announcements or in the annual report. Religare did not answer questions on the terms and details. “This was part of the JV agreement and was disclosed to relevant authorities at the time of signing in September 2012. This is a commercial arrangement between the two shareholders and is confidential in nature, that cannot be shared. Also, the deal is subject to necessary regulatory clearances and approvals,” Godhwani added.

While Religare is silent about the deal’s size, news reports have put it at Rs 600-700 crore. That is twice the amount Religare got for selling stake to Invesco three years before. According to its FY13 annual report, Religare had booked a “profit of Rs 320.84 crore (net of expenses) on sale of the said 39.03 per cent shareholding”. It had bought the asset management company (AMC) business of erstwhile Lotus Mutual Fund (MF) at a near-zero price.

People familiar with the asset management business feel there are business reasons for Religare to have agreed to the exercise of the option. A senior national distributor of MFs said the transaction seems a purely business call, based on the profitability and prospects for a mid-sized fund house in the present environment. “Of the three dozen AMCs in business, only eight or 10 are profitable. Of these, only four or five are immensely profitable, that justifies long-term investment. Regulatory policies in the past few years have made the environment even more skewed in favour of the bigger AMCs. Mid-level AMCs are getting marginalised. This industry is only for people with very deep pockets and those who can stay for the very long term,” the distributor said.

Despite its growing asset base, Religare Invesco contributed only Rs 1.25 crore as profit to the Religare bottom line, according to the FY15 annual report. In FY14, its contribution was a loss of Rs 8.6 crore or 12.4 per cent of the consolidated numbers for Religare Enterprises.

But, Religare’s ‘sell’ calls are not limited to the tightly regulated local AMC business. A week after the MF deal, the company said its subsidiary, Religare Global Asset Management, was selling its Singapore-based Religare Health Trustee Manager (Pte) Ltd for $14.9 million to a subsidiary of group company Fortis Healthcare. Gurpreet Singh Dhillon, related to the promoters’ spiritual guru, was the chief executive of this entity.

This was the third such sale in the past six months since the company’s exit from its life insurance joint venture with Aegon. The serial sale subsidiaries and speculation about the long-term plans of the promoters has had some impact on the stock in these months. From Rs 385.65 a share in late April, the stock lost 31 per cent to hit Rs 265, soon after announcement of sale of the MF business. It has recovered somewhat, rallying 8.7 per cent on Tuesday to close at Rs 302.5 on the BSE.

Even after this rally, it is about 21 per cent lower from the highs hit in April. In comparison, during the same period, the benchmark Sensex has lost 5.5 per cent and the BSE 500, of which Religare was a part, fell about three per cent.

A senior analyst with a brokerage, who doesn’t want to named, points to the knack of Religare’s promoters, the Singh brothers, in identifying exits.The brothers had sold off their flagship Ranbaxy Laboratories three months before the collapse of Lehman Brothers, which triggered the global financial crisis.

“The financial services business has not panned out the way it was expected to when Religare first entered the business a decade ago. The banking licence the group was vying for has also not come. So, it makes sense to avail of these exit opportunities when the market is benign,” the analyst added.

The fabled Ranbaxy sale to Daiichi has landed in an arbitration court in Singapore, after drug regulators in the US slapped huge penalties. When asked if these events had any bearing on Religare's strategy, Godhwani said, “The promoter family exited Ranbaxy in 2008. That was a separate business altogether and had no linkages with Religare.” He also ruled out any connection with the younger Singh brother’s recent decision to go the spiritual way. “None whatsoever. The spiritual path taken by promoters is something personal and has no correlation with Religare businesses.”

He says Religare continues to have a significant play in asset management through its 'Alternatives-focused multi boutique' global asset management business, managing assets of $20 billion. “It is unfair on your part to speculate. There is absolutely no rethink whatsoever on our overall chosen and stated path of being a significant financial services player of scale and size. Both our exits were thought through and part of a broader strategic and operating plan. Also, the decision to exit our life insurance JV with Aegon was taken last year, post a strategic review of the business.”

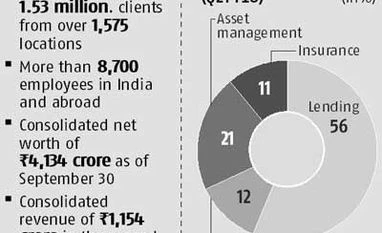

The thinking within Religare also seems to be that the exits would free-up capital for the health insurance and small & medium enterprises (SME) financing verticals, where the company sees lot of potential. According to Godhwani, the SME finance lending business continues to grow its book at a healthy rate, while staying focused on generating superior returns on equity. “The health insurance business again grows steadily and rapidly ahead of our operating targets, while remaining focused on being a capital-efficient platform. Our capital markets and wealth platform continue to stay true to its agenda of improving market share, yield and profitability,” he said.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 01 2015 | 10:46 PM IST