Traders roll over fewer positions

Nifty's tight range-bound movement makes it tedious for them to create aggressive positions

)

Ahead of the expiry of February contracts on Thursday, traders carried forward fewer derivative positions to the March series, discouraged by the range-bound moves in the benchmark indices in the last few weeks.

Analysts said the Nifty’s movement in a tight range had made it tedious for traders to create aggressive positions. “Long-side aggression was missing in the market in this rollover session, as the markets have largely been lacklustre. There was lack of participation and this could continue going into the next month,” said Yogesh Radke, head of quantitative research, Edelweiss Securities.

The rollover in Nifty futures to the March series was about 65 per cent, compared with 72 per cent when January contracts expired last month. “The rollover in the Nifty was less this time, both in terms of percentage and open interest. Investors are going into the March series light-positioned. We are taking it as a positive because most positions rolled over were negative last time,” said Siddharth Bhamre, head of derivatives, Angel Broking. Open interest positions in the Nifty futures saw a 20-25 per cent decline in the February series, analysts said.

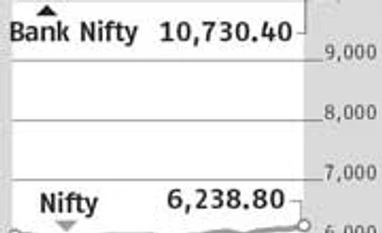

On Wednesday, the National Stock Exchange Nifty rose 0.62 per cent, closing at 6,238. The futures and options expiry session was held on Wednesday, as markets would remain closed on Thursday on account of Mahashivratri.

Radke said the Nifty was likely to move between 6,100 and 6,350 in the March series, too.

“Optimism in the market will remain as long as the Nifty is able to hold above 6,150-levels. The only immediate negative trigger could be in the form of less-than-expected fourth quarter GDP (gross domestic product) data to be released on Friday. The overall sentiment, however, continues to remain positive,” said Ashish Chaturmohta, head of technical and derivatives analysis, Fortune Equity Broker.

In the last two-three trading sessions, foreign institutional investors were seen taking long positions in index futures, reflecting the change in market sentiment.

Rollover of positions across futures contracts was 76 per cent, in line with the trend seen at the end of the January series. “This clearly indicates there was more stock-specific movement in rollovers than in index futures. Long position build-up was seen in stocks of the technology and health care sectors, while investors remained short on stocks of metals and public sector companies,” said Amit Gupta, head of derivatives, ICICI Direct.

Traders created long positions in futures contracts of capital goods makers such as Voltas, BHEL and Crompton Greaves. Automobile stocks also witnessed a build-up of bullish bets.

Investors and analysts remain divided on the outlook on health care stocks. While investors were seen building long positions in the sector, particularly in stocks such as Sun Pharma and Lupin, analysts advised caution companies in this space, as they believe the sector has seen significant gains in the past few months.

Rollovers in bank Nifty futures, which saw heavy short-position build-up in the January series, remained flat in the February series. “Long position build-up was seen among private sector stocks, while the short-position build-up for public sector banks was largely flat. Even within the state-owned banks space, short positions were higher in case of the mid-cap names,” said Chaturmohta.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 26 2014 | 10:50 PM IST