Banning cough syrups will hit Pfizer most

Its brand Corex is a big contributor to revenues, but measure may reduce earnings estimate for firm

)

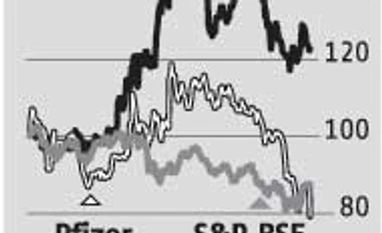

The health ministry’s move to ban 350-odd fixed-dose combinations on safety concerns has jolted many pharmaceutical firms. Experts, going by data from AIOCD Pharmasofttech Awacs, believe that 3.91 per cent (revenues of Rs 2,000 crore) of the overall Indian pharma market may get hit. Among the bigger setbacks is the ban of over-the-counter (OTC) cough syrups brands like Corex (of Pfizer) and Phensedyl (of Abbott). Pfizer on Monday contested the order in courts, which have stayed the order. But if the ban is implemented going ahead, it will hurt firms such as Pfizer and Abbott: their Corex and Phensedyl, respectively, are among the top-five selling brands, with per-year revenues of over Rs 200 crore and margins of 35 per cent plus. Corex alone is believed to have contributed Rs 180 crore to Pfizer’s revenues of Rs 1,500 crore in the first nine months of FY16. Pfizer’s stock fell 8.7 per cent to close at Rs 1,761 on Monday.

Phensedyl sales, which contribute significantly, are not accounted for in the listed entity Abbott India. Hence, the stock ended half a per cent up to close at Rs 4,880.Read more from our special coverage on "PFIZER"

If the cough syrups go off shelves, the respiratory market will be the most hit (17 per cent of domestic sales), say experts. Among other segments anti-pain (8.2 per cent), anti-diabetic (7.68 per cent) and anti-infective drugs will also get hit due to the order. However, among other companies, initial estimates peg the Earnings Per Share impact for Ipca Laboratories at Rs 1.8, Sun Pharmaceutical’s at Rs 0.1, and Lupin’s at Rs 0.2, says Karvy Stock Broking.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 14 2016 | 9:36 PM IST