Indian Hotels to gain from premium segment demand

Despite re-rating, steam still left as price targets are Rs 160-200

)

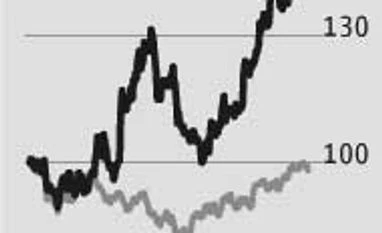

With hotel demand outpacing supply, especially in the premium space, Indian Hotels Company Limited is best placed to capitalise on this trend. Not surprisingly, its stock hit an all-time intra-day high of Rs 138 on Friday, before closing at Rs 134. And there could be more gains going ahead.

Consider this. From under 60 per cent occupancy rate in FY15, premium segment occupancy rates are expected to move up to 66 per cent in FY17. The expansion, according to Elara Capital, is expected to come from corporate and domestic travellers as well as events. Occupancy rates indicate the percentage of available (operational) rooms rented out by a hotel. Typically, an increase in occupancy leads to strong gains in profitability.

Over the medium term, aggregate revenue per available room for the premium segment is expected to rise five per cent to Rs 5,350 by 2019-20, according to Binaifer Jehani, director, CRISIL research. This will largely be led by improving business sentiment, growth in foreign tourist arrivals, and better occupancies due to narrowing inventory growth.

What helps luxury players is the limited land, high capital expenditure (capex), and long time to build properties, all of which constrain supply, leading to higher occupancy ratios and room rates. Luxury segment outpacing sectoral growth should help Indian Hotels as 60 per cent of its rooms and 96 per cent of its earnings before interest and taxes are contributed by luxury properties — Taj and Vivanta.

ICRA estimates that revenue growth for the sector should improve on the back of higher domestic demand and return of pricing power.

Citing past trends, analysts at Edel Invest Research say a slight growth in occupancy ratio leads to a huge upswing in operating profit margin due to high operating leverage (occupancy-led gains). It estimates that Indian Hotels’ operating profit margin, currently at 13 per cent, will move to 22 per cent by FY19 as occupancy ratio jumps from 62 to 70 per cent.

Recent news flow on reducing debt has also helped boost the Indian Hotels’ stock. After exiting from its investment in Orient-Express Hotels (now Belmond), the company last month announced the sale of its loss-making US property, Taj Boston, for $125 million. The company will, however, continue to run the hotel under a management contract. These moves, according to analysts, should help bring down debt from Rs 4,400 crore to Rs 3,200 crore and net debt-equity ratio to one now as against 1.4 in March.

Given the expected improvement in outlook, analysts have upgraded their earnings (net profit) per share (EPS) estimates for FY17 and FY18. The company had reported a consolidated loss of Rs 60 crore in FY16. Given analysts’ stock price targets of Rs 160-200, there is scope for more upside.

Consider this. From under 60 per cent occupancy rate in FY15, premium segment occupancy rates are expected to move up to 66 per cent in FY17. The expansion, according to Elara Capital, is expected to come from corporate and domestic travellers as well as events. Occupancy rates indicate the percentage of available (operational) rooms rented out by a hotel. Typically, an increase in occupancy leads to strong gains in profitability.

Over the medium term, aggregate revenue per available room for the premium segment is expected to rise five per cent to Rs 5,350 by 2019-20, according to Binaifer Jehani, director, CRISIL research. This will largely be led by improving business sentiment, growth in foreign tourist arrivals, and better occupancies due to narrowing inventory growth.

What helps luxury players is the limited land, high capital expenditure (capex), and long time to build properties, all of which constrain supply, leading to higher occupancy ratios and room rates. Luxury segment outpacing sectoral growth should help Indian Hotels as 60 per cent of its rooms and 96 per cent of its earnings before interest and taxes are contributed by luxury properties — Taj and Vivanta.

ICRA estimates that revenue growth for the sector should improve on the back of higher domestic demand and return of pricing power.

Citing past trends, analysts at Edel Invest Research say a slight growth in occupancy ratio leads to a huge upswing in operating profit margin due to high operating leverage (occupancy-led gains). It estimates that Indian Hotels’ operating profit margin, currently at 13 per cent, will move to 22 per cent by FY19 as occupancy ratio jumps from 62 to 70 per cent.

Given the expected improvement in outlook, analysts have upgraded their earnings (net profit) per share (EPS) estimates for FY17 and FY18. The company had reported a consolidated loss of Rs 60 crore in FY16. Given analysts’ stock price targets of Rs 160-200, there is scope for more upside.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 03 2016 | 10:22 PM IST