Jet Airways: International business is the only hope

Seeks to raise share of international biz to 60%, margins expected to improve on stronger rupee

)

Jet Airways may be struggling to make profits, but the Street is not concerned because of the company's focus on growing its footprint in the international market. While the share of international revenues is growing, market share in the domestic market continues to decline. In July, it has been displaced by SpiceJet from second position to third its market share dropped to 19.6 per cent and SpiceJet's was 21 per cent. Analysts believe the international business is Jet's only hope.

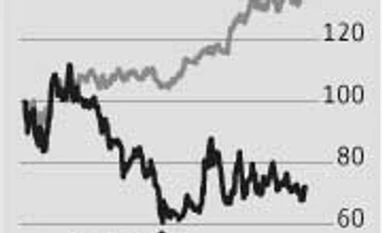

As a strategy, analysts and investors like this because growth and margins are better in the international business. In the June quarter, the company's standalone domestic revenues grew 7.7 per cent and international revenues grew 24 per cent. As a result, the combined revenue growth was 17 per cent year-on-year to Rs 4,686 crore. Shares of Jet Airways are up 13 per cent in six months.

The growth in international business is also a positive because it gives Jet a natural hedge against currency volatility. Also, the past two years have been seen weak growth in the domestic market. Jet's been steadily losing market share in India, from a peak of 29.3 per cent in the March quarter of FY12 to 24 per cent in March 2014. In the first quarter of FY15, Jet's domestic market share declined further. According to ICICIDirect, Jet reported only 1.1 per cent CAGR during FY11-14 in domestic passenger traffic growth, against a sectoral traffic CAGR of 4.2 per cent during the period.

The rupee's weakness and falling profitability have not helped. Currency weakness leads to higher lease rental payouts. Given that its domestic market share is declining and margins are weak, Jet's strategy to focus on international business is a positive. The focus is also paying off as the share of international business in overall revenues has increased to 53 per cent in FY14 from 51 per cent in FY11. Analysts believe this share to cross 60 per cent levels over the next two or three years, with Etihad coming on board and providing with better international connectivity to Jet's passengers. ICICIDirect's Rashesh Shah says Etihad has already been given regulatory approval to codeshare on 43 additional routes with Jet bringing the total number of services under code-share to 71.

"The new code-sharing agreement will help passengers travelling from the country to connect to flights on the Etihad network via Abu Dhabi to European destinations," he said. With competition in the domestic market heating up in the wake of new airlines taking wings, Jet's international play may prove to be rewarding. From a profitability point of view, too, the international business has come to save the day for Jet. Analysts have a positive view on the stock, thanks to this and possibility of a demand revival in India.

The growth in international business is also a positive because it gives Jet a natural hedge against currency volatility. Also, the past two years have been seen weak growth in the domestic market. Jet's been steadily losing market share in India, from a peak of 29.3 per cent in the March quarter of FY12 to 24 per cent in March 2014. In the first quarter of FY15, Jet's domestic market share declined further. According to ICICIDirect, Jet reported only 1.1 per cent CAGR during FY11-14 in domestic passenger traffic growth, against a sectoral traffic CAGR of 4.2 per cent during the period.

The rupee's weakness and falling profitability have not helped. Currency weakness leads to higher lease rental payouts. Given that its domestic market share is declining and margins are weak, Jet's strategy to focus on international business is a positive. The focus is also paying off as the share of international business in overall revenues has increased to 53 per cent in FY14 from 51 per cent in FY11. Analysts believe this share to cross 60 per cent levels over the next two or three years, with Etihad coming on board and providing with better international connectivity to Jet's passengers. ICICIDirect's Rashesh Shah says Etihad has already been given regulatory approval to codeshare on 43 additional routes with Jet bringing the total number of services under code-share to 71.

"The new code-sharing agreement will help passengers travelling from the country to connect to flights on the Etihad network via Abu Dhabi to European destinations," he said. With competition in the domestic market heating up in the wake of new airlines taking wings, Jet's international play may prove to be rewarding. From a profitability point of view, too, the international business has come to save the day for Jet. Analysts have a positive view on the stock, thanks to this and possibility of a demand revival in India.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 20 2014 | 10:36 PM IST