NHPC shares drop 3% even as Q2 profit rises 15%; What's weighing the stock?

NHPC shares fell 3 per cent after its second-quarter earnings for the financial year 2025-26 missed the street's expectations

)

NHPC shares Price Today

Listen to This Article

Shares of NHPC Ltd. fell over 3 per cent on Friday after the company's second-quarter earnings for the financial year 2025-26 missed the street's expectations on one-off factors.

The power generation company's stock fell as much as 3.14 per cent during the day to ₹80.25 per share, the steepest fall since September 26. The stock pared losses to trade 2.4 per cent lower at ₹80.85 apiece, compared to a 0.52 per cent decline in Nifty 50 as of 10:54 AM.

Shares of the company fell for the third straight session and currently trade at 2.7 times the average 30-day trading volume, according to Bloomberg. The counter has fallen 0.04 per cent this year, compared to a 7.1 per cent advance in the benchmark Nifty 50. NHPC has a total market capitalisation of ₹81,123.70 crore.

NHPC Q2 results

The hydro power giant NHPC posted a nearly 15 per cent rise in its consolidated net profit to ₹1,219.28 crore in the September quarter compared to a year ago, mainly on the back of higher revenues. The company had a consolidated net profit of ₹1,060.34 crore in the quarter ended on September 30, 2024.

Also Read

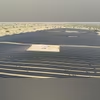

Total income rose to ₹3,629.98 crore in the quarter against ₹3,402.09 crore in the same period a year ago. The company has set a capital expenditure target of ₹13,100 crore for FY26, marking a 13 per cent year-on-year increase. It currently has 8,514 megawatts (Mw) of hydro and 1,190 megawatts of solar projects under construction.

JM Financial on NHPC earnings

NHPC reported consolidated net revenue came in 7 per cent below JM Financial’s estimate and 22 per cent below consensus. The growth was driven by an 11 per cent rise in power generation.

Ebitda stood at ₹2,000 crore, up 12 per cent year-on-year (Y-o-Y) but 6 per cent lower than JM Financial’s estimate and 18 per cent below consensus. Adjusted for a one-off minimum alternate tax (MAT) credit of ₹230 crore, adjusted profit after tax rose 39 per cent year-on-year to ₹1,250 crore, broadly in line with estimates.

The Parbati-II project, commissioned in April 2025, was not operational during the quarter due to flash floods, resulting in an estimated loss of around ₹160 crore, according to JM Financial. The company expects to commission four units of the 8x250 Mw Subansiri Lower project in FY26, with the remaining four units, along with the 120 Mw Rangit-IV and 624 Mw Kiru projects, targeted for FY27.

JM Financial said NHPC’s regulated equity is likely to rise from ₹14,200 crore in FY25 to ₹28,000 crore by FY28. The brokerage maintained a 'Buy' rating on the stock with a target price of ₹96, citing its fully green energy portfolio and strong growth outlook.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 07 2025 | 11:05 AM IST