Hidden jewels get a polish at Tata group

Four smaller firms in the infra & technology space on course to more than treble their revenue to Rs 24,000 cr in four years

)

They are the pygmies in the Tata group, which has over 100 operating companies in seven business sectors. And, conventional wisdom suggests these should remain on the back burner at a conglomerate facing huge sales and profit growth challenges in some of its largest businesses.

But Chairman Cyrus Mistry has different ideas. Apart from the focus on the three big companies, which account for over 70 per cent of the group's combined sales, Mistry has decided to polish some of his group's hidden gems as well. So, the group has decided to increase its focus on some of the less-known companies, such as Tata Projects, Tata Housing, Tata Technologies and Tata Elxsi.

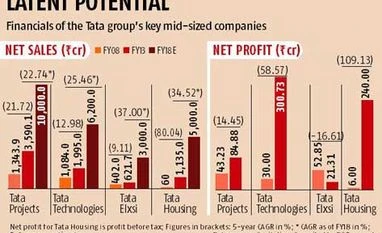

These four, from the infrastructure and technology space, are expected to more than treble their revenue to Rs 24,000 crore in four years - from around Rs 7,400 crore last financial year.

The heads of these companies are in tune with the group chairman's theme song. "We aspire to be in engineering and design for manufacturers what TCS is in IT services," says Patrick McGoldrick, MD & CEO of the 24-year old Tata Technologies, speaking over phone from the company's Singapore headquarters. The company provides its services to Tier-I automotive and aerospace original equipment manufacturers and its suppliers earned revenue of Rs 2,045 crore in 2012-13. The unlisted entity has set an internal target to earn $1 billion (about Rs 6,200 crore) of revenue by the end of 2017.

To seek rapid growth, Tata Technologies is now targeting opportunities in the heavy engineering business, which contributed less than five per cent to its revenue in 2012-13. The company, which acquired US-based Cambric Corporation in April for $32.5 million to tap the opportunities in heavy engineering business, also plans to tap the rapidly growing offshore market.

Tata Elxsi, another group firm in the business of designing embedded electronics, is aiming for rapid growth after exiting the loss-making animation business about a year back. Following the exit, its annual revenue grew 22 per cent to Rs 622 crore in 2012-13.

"By 2015-16 we should be back to a 40 per cent year-on-year growth rate. Then, we will see how we can get to a 60 per cent growth rate," says Madhukar Dev, MD & CEO of Tata Elxsi. At this rate, over the next three-four years, the company is expected to reach a revenue level of Rs 2,000-3,000 crore. The company expects the country's electronics manufacturing to be about $100 billion by 2020. That would fuel its rapid growth as a design company.

Mistry's keen interest in construction and infrastructure business has also brought companies like Tata Projects and Tata Housing to the fore.

The turnover of Tata Projects, an engineering, procurement and construction (EPC) contracting company, grew 17 per cent on an annual basis to Rs 3,590 crore in 2012-13. It has maintained 22 per cent CAGR in revenue for the past five years, while completing Rs 15,000 crore worth of projects.

The 34-year-old company that executes EPC contracts across industries like power generation, transmission & distribution, metal & minerals, oil & gas, railways and water systems management has got an order book of Rs 15,000 crore for the next three years. This will make it a Rs 10,000-crore turnover company by March 2018.

"Within our business verticals, we are looking at increasing scope and scale, new addressable markets and new geographies," says Tata Projects MD Vinayak Deshpande. The company expects new business growth to come from build-operate-transfer and public-private partnership contracts. "Urban infrastructure, where we have synergy with our industrial infrastructure - like urban transport - are being ventured into. These new forays shall cumulatively drive growth in the next three to five years," Deshpande says.

The company has identified the addressable size of the market it operates in at worth Rs 80,000 crore to Rs 100,000 crore a year over the next three-five years.

Tata Housing and Development, the other company from the infrastructure space, has grown at a CAGR of 80 per cent in the past five years. The over 29-year-old group firm that had a revenue of as little as Rs 36 crore in 2006, rediscovered itself by foraying into low-cost housing. It recorded Rs 1,135 crore of revenue in 2012-13.

The company currently has 29 projects - around 70 million square feet of properties under various stages of development - at 13 locations across the country. This has an aggregate revenue potential of Rs 33,000 crore. At a higher revenue base, it expects to grow at a CAGR of 30-40 per cent for the next five years to achieve the Rs 5,000-crore annual turnover target.

"The strength of the group is that while there is continuity, one is striving to do even better every year," says Brotin Banerjee, MD & CEO, Tata Housing & Development.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 04 2013 | 12:55 AM IST