PSU divestment likely to start with Coal India, ONGC

Govt was earlier planning to begin this year's disinvestment with a 5% stake sale in SAIL in Sept

)

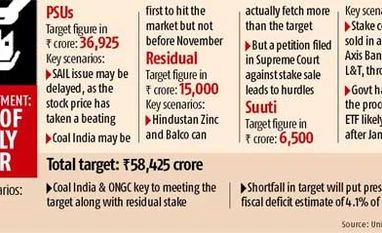

The government's disinvestment programme might start with a big issue like that of Coal India Ltd or Oil and Natural Gas Corporation Ltd (ONGC) next month, while stake sales in Steel Authority of India Ltd (SAIL) could be put on hold.

Coal India's valuation has shot up after the Supreme Court's verdict cancelling private coal blocks last month. The government's decision on Monday provided more clarity. On the other hand, SAIL's stock price has dived in the past few weeks with a rise in steel prices.

The government was earlier planning to begin this year's disinvestment with a five per cent stake sale in SAIL in September. "The stock price of SAIL has fallen sharply. So, there may be a delay there till the valuation goes up again," said a finance ministry official, who did not wish to be named.

The decks have also been cleared for divestment in ONGC, with the Union Cabinet providing clarity on gas pricing last Saturday. Disinvestment Secretary Aradhana Johri met bankers in Mumbai on Monday to discuss the sale, likely to fetch around Rs 18,000 crore to the government, against Rs 22,800 crore expected from Coal India.

The finance ministry will also approach the Cabinet soon for selling five per cent stakes in Rural Electrification Corporation and Power Finance Corporation. Finance Minister Arun Jaitley has given his approval to these.

"Coal India and NHPC may be the first to be divested. We are also in the process of taking Cabinet approval for some power companies. Now, there is clarity on ONGC, too. But nothing is likely to happen before November," another official said on condition of anonymity.

Sales of a 10 per cent stake in Coal India and five per cent in ONGC could be enough for the government to meet its target of Rs 36,925 crore from disinvestment in public sector undertakings.

"These are low-hanging fruits. These are quality assets and there would be takers for these issues. It would be better if the government kick-starts their disinvestment right away," said Jagannadham Thunuguntla, chief strategist, SMC Global.

The sale of the government's stakes in ITC, Larsen & Toubro and Axis Bank, held through the Specified Undertaking of the Unit Trust of India, may take place in the January-March quarter through an exchange traded fund comprising other blue-chip companies. "Procedural formalities have started and it will take three to four months to launch the ETF. It will be a basket of these three companies as well as some other PSUs," said the first official quoted above.

The sale of residual stakes in Hindustan Zinc and Balco can fetch the government much more than the targeted Rs 15,000 crore. However, the government has told the Supreme Court the stake sale in Hindustan Zinc will take at least another four months. The apex court is hearing a petition challenging the sale. "In the case of the residual stake sale, a court case is going on. It is a long drawn process and we may not necessarily be able to do it this year," said the second official.

The government's target is to raise Rs 58,425 crore from disinvestment this year, 269 per cent higher than last year's Rs 15,819 crore. If the target is missed, the government will find it difficult to meet its fiscal deficit target of 4.1 per cent of the GDP for 2014-15.

Another official said the government might go to the market even valuations were low. "Some amount here or there does not matter. The government has considerations other than valuation. The fiscal deficit is a concern," the official added. The government is planning to give attractive discounts for retail customers to encourage participation in the disinvestment programme.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 21 2014 | 12:50 AM IST