After Subbarao's talk, rupee records biggest intra-day gain in 2013

BS-Poll shows the Indian currency to stay below 60 against dollar in near term

)

A day after slipping more than 100 basis points (bps) following dovish statement from the Reserve Bank of India (RBI), the rupee recovered in late trade on Wednesday after the hawkish tone of top RBI officials’ comments. Intervention by the central bank in the foreign exchange market also helped the currency appreciate against the dollar.

On Wednesday, RBI Governor D Subbarao said in a post-monetary policy interaction conference call with analysts and researchers that the central bank would respond to the evolving situation with all instruments at their command. These instruments also include bond sales to further drain liquidity.

However, Subbarao maintained that among the menu of options available to the central bank, sovereign bonds auction is the least preferred.

On Wednesday, the rupee recorded its biggest intra-day gain in calendar year 2013. The currency was about to touch a fresh all-time low, but dollar sales by state-run banks on behalf of RBI helped it recover. The rupee ended at 60.37 a dollar, compared with the previous close of 60.49. During intra-day trades, the currency touched a low of 61.17, very close to the all-time low of 61.22 registered on July 8. The rupee had opened at 60.86 on Wednesday.

“All the options are on the table and are under consideration and we are engaged in discussions with the government and we will do whatever is best,” said Subbarao.

According to him, RBI’s efforts to curb volatility in the exchange rate are aimed among other things to make investment in equity attractive and promising. “More inflows must come. Inflows that are already here should stay here and we believe that a stable exchange rate is important for that purpose,” said Subbarao.

The Street expects the rupee to strengthen from current levels in the next one month and trade below the Rs 60 per dollar mark. According to currency dealers, although RBI keeps saying it is not targeting a particular level for the rupee, it will ensure the Indian currency is not allowed to weaken significantly.

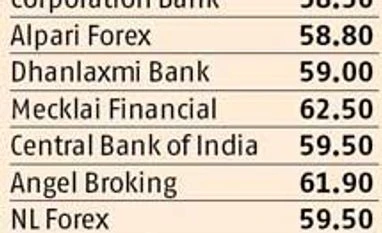

The median forecasts poll from 10 currency experts done by Business Standard shows the rupee is expected to trade at Rs 59.50 per dollar in a month’s time.

On Wednesday, RBI Governor D Subbarao said in a post-monetary policy interaction conference call with analysts and researchers that the central bank would respond to the evolving situation with all instruments at their command. These instruments also include bond sales to further drain liquidity.

However, Subbarao maintained that among the menu of options available to the central bank, sovereign bonds auction is the least preferred.

On Wednesday, the rupee recorded its biggest intra-day gain in calendar year 2013. The currency was about to touch a fresh all-time low, but dollar sales by state-run banks on behalf of RBI helped it recover. The rupee ended at 60.37 a dollar, compared with the previous close of 60.49. During intra-day trades, the currency touched a low of 61.17, very close to the all-time low of 61.22 registered on July 8. The rupee had opened at 60.86 on Wednesday.

“All the options are on the table and are under consideration and we are engaged in discussions with the government and we will do whatever is best,” said Subbarao.

The median forecasts poll from 10 currency experts done by Business Standard shows the rupee is expected to trade at Rs 59.50 per dollar in a month’s time.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 01 2013 | 12:36 AM IST