ICICI Pru Life IPO to open on Sep 19

Fifth largest IPO in the domestic market

)

ICICI Prudential Life Insurance company’s Rs 6,057-crore initial public offering (IPO) - the first by an Indian insurance company - will hit the markets on September 19. The issue is priced in the range of Rs 300-334 per share.

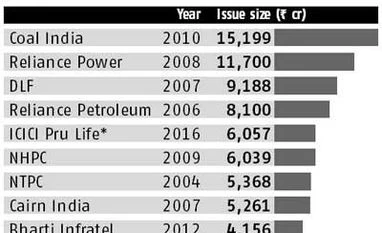

ICICI Bank, which owns 68 per cent stake in the company, will sell 12.65 per cent stake (over 181 million shares) in the IPO. At the top end of the price band, the IPO will raise Rs 6,057 crore, making it the fifth largest IPO in the domestic market and biggest since Coal India’s in 2010. At the lower end, it will be able to mop up Rs 5,440 crore. The life insurer will be valued anywhere between Rs 43,000 crore and Rs 47,890 crore, depending on where the issue gets priced.

Shares of ICICI Bank on Friday ended 0.8 per cent lower at Rs 274. At current market price, ICICI Bank is valued at Rs 1.59 lakh crore. The lender’s stake in its insurance subsidiary is valued at as much as Rs 32,500 crore.

Shares of ICICI Bank on Friday ended 0.8 per cent lower at Rs 274. At current market price, ICICI Bank is valued at Rs 1.59 lakh crore. The lender’s stake in its insurance subsidiary is valued at as much as Rs 32,500 crore.

Interestingly, ICICI Pru Life’s valuation has soared over 45 per cent in less than a year. The insurer was valued at Rs 32,500 crore in November 2015, when ICICI Bank sold six per cent stake to Wipro’s Azim Premji entity and Singapore government’s Temasek.

Britain’s Prudential Holdings, which owns nearly 26 per cent in the insurer, will not be selling any stake in the IPO. The IPO, however, will allow participation from overseas investors, as their investment ceiling in insurance companies has been hiked from 26 per cent to 49 per cent by the government earlier this year.

ICICI Pru Life’s IPO is coming at a time when both the primary and the secondary market are witnessing buoyancy. The benchmark indices are close to their all-time highs, while the capital-raising through IPOs is set to climb to six-year high level.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 09 2016 | 11:58 PM IST