Expensively valued, little cheer on operations

Given lower growth rates, pricing policy overhang, the stock's premium valuations seem unjustified

)

The GlaxoSmithKline Pharm-aceuticals stock spurted 20 per cent over the past three trading sessions on reports that parent GSK Plc was raising stake in its subsidiary to 75 per cent from the current 50.67 per cent through an open offer.

GSK Plc had in November last year come out with an offer for its consumer arm, GSK Consumer Healthcare, at a 28 per cent premium to the prevailing price. While there is no official announcement on the issue and GSK Pharma says it does not comment on speculation, the spurt in prices is on the expectation that the open offer would be at a similar premium.

Among other potential catalysts are new launches from parent GSK’s innovative portfolio, new branded generic launches and inorganic initiatives/dividends to utilise cash and equivalents at Rs 2,100 crore, say Prashant Nair and Anshuman Gupta of Citi Research.

On the flip side, given its premium pricing strategy for lead brands and with over a third of its drugs falling under the proposed price control regime, the biggest overhang for the stock will be the new pricing policy (the prices are yet to be announced). Analysts at Emkay Global estimate earnings per share (EPS) might get impacted by 17 per cent in calendar year (CY) 2013.

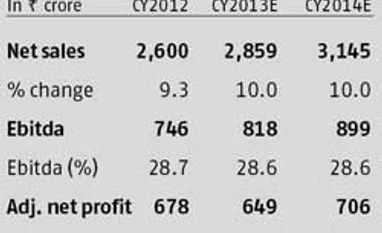

On the operational front, performance has not been up to Street expectations and it has been lagging its peers on the domestic sales growth parameter. Analysts estimate the company, which achieved sales growth of 11 per cent in CY12, is expected to end the current financial year at about 10 per cent top line growth, less than the growth rates of expected for larger players.

Given slower growth, pricing policy and the recent spurt in stock prices, analysts believe the stock is expensively valued at current levels. At Rs 2,755, it is trading at a one-year forward price to earnings multiple of 27-30 times, which is at a steep premium to some of the larger pharma peers, trading at 20-22 times the one-year forward. Given that its peers are growing at double its growth rates and will be less impacted than the company due to the new domestic pricing policy, the steep valuations are not justified, says a pharma analyst.

The company had a poor March quarter on revenue due to supply chain issues. For the quarter, this grew just 1.5 per cent, which impacted margins and net profits.

While the margins fell to 25.8 per cent, the lowest since 2006, due to higher fixed overheads as well as raw material costs, adjusted net profit fell eight per cent over the year-ago quarter. The reported net profit numbers, however, are up 37 per cent, due to other income and a lower tax rate.

According to Quant Global Research, the company’s Ebitda (earnings before interest, taxes, depreciation and amortisation) margins have been on the decline for five quarters due to slow growth in anti-infectives, input costs and supply chain issues. The company expects supply chain issues to get sorted out over the next quarter.

On pharma pricing, analysts say higher volumes might partially help overcome price erosion.

The other area where GSK Pharma is likely to focus on is the launch of new products. The company has prepared a slew of launches in both the vaccine and chronic therapy segments. This could help support growth rates in the medium term.

GSK Plc had in November last year come out with an offer for its consumer arm, GSK Consumer Healthcare, at a 28 per cent premium to the prevailing price. While there is no official announcement on the issue and GSK Pharma says it does not comment on speculation, the spurt in prices is on the expectation that the open offer would be at a similar premium.

Among other potential catalysts are new launches from parent GSK’s innovative portfolio, new branded generic launches and inorganic initiatives/dividends to utilise cash and equivalents at Rs 2,100 crore, say Prashant Nair and Anshuman Gupta of Citi Research.

On the flip side, given its premium pricing strategy for lead brands and with over a third of its drugs falling under the proposed price control regime, the biggest overhang for the stock will be the new pricing policy (the prices are yet to be announced). Analysts at Emkay Global estimate earnings per share (EPS) might get impacted by 17 per cent in calendar year (CY) 2013.

On the operational front, performance has not been up to Street expectations and it has been lagging its peers on the domestic sales growth parameter. Analysts estimate the company, which achieved sales growth of 11 per cent in CY12, is expected to end the current financial year at about 10 per cent top line growth, less than the growth rates of expected for larger players.

Given slower growth, pricing policy and the recent spurt in stock prices, analysts believe the stock is expensively valued at current levels. At Rs 2,755, it is trading at a one-year forward price to earnings multiple of 27-30 times, which is at a steep premium to some of the larger pharma peers, trading at 20-22 times the one-year forward. Given that its peers are growing at double its growth rates and will be less impacted than the company due to the new domestic pricing policy, the steep valuations are not justified, says a pharma analyst.

While the margins fell to 25.8 per cent, the lowest since 2006, due to higher fixed overheads as well as raw material costs, adjusted net profit fell eight per cent over the year-ago quarter. The reported net profit numbers, however, are up 37 per cent, due to other income and a lower tax rate.

According to Quant Global Research, the company’s Ebitda (earnings before interest, taxes, depreciation and amortisation) margins have been on the decline for five quarters due to slow growth in anti-infectives, input costs and supply chain issues. The company expects supply chain issues to get sorted out over the next quarter.

On pharma pricing, analysts say higher volumes might partially help overcome price erosion.

The other area where GSK Pharma is likely to focus on is the launch of new products. The company has prepared a slew of launches in both the vaccine and chronic therapy segments. This could help support growth rates in the medium term.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 04 2013 | 9:25 PM IST