Nifty 7,241-7,250 is a crucial support zone

On the upside, look for a move beyond 7,600 setting up higher highs. On the downside, look for a fall below 7,240, for lower lows

)

There was heavy selling late on Monday, though India's gross domestic product (GDP) estimates and projections came along expected lines. Given the Chinese New Year, traders will be more focused on India during this week. Volumes may be low. Although the official GDP projections seem ok, the corporate results have been lacklustre.

The major trend still seems down. The Nifty reacted from a high of 7,600 on February 1. This is much lower than the prior high of 7,831 on January 5 and it maintains a bearish pattern of lower highs. However, lower lows have not yet been recorded in the latest downturn although we would expect lower lows if the major trend is down. The acid test would be a test of support at 7,250 and a fall below the current 52-low of 7,241 (January 20).

So, these are the points to watch for chartists. On the upside, look for a move beyond 7,600 setting up higher highs. On the downside, look for a fall below 7,240, for lower lows. The support at 7,200-7,250 looks fairly solid. As of Monday, the Nifty had bounced from support at 7,360. The bear market has lasted 11 months, with a correction from the all-time peak of 9,119 (March 2015).

FIIs have been sellers of equity since November 2015 but the volume of selling reduced last week. Retail investors have started selling in the past 10 sessions.Domestic Institutions remain net positive, but on low net volumes.

A bounce till 7,750-7,850 levels could come quickly. The Nifty fell almost vertically from 7,800 to 7,250. One obvious trigger could be the possibility of strong rumours around the Budget, which drive the market up.

The Bank Nifty has run weaker than the overall market, which is unusual. As of now, most public-sector banks are near their respective 52-week lows and private banks have also seen selling on poor results. The Bank Nifty is just one big session away from a new 52-week low. A bearspread with an on-the-money long 15,000p (279), short 14,000p (51) costs 228. It could pay a maximum of 772. It would take just three or four big sessions to traverse 1,000 points.

An optimist hoping for bank sops in the Budget may try a long strangle, with a long 14,000p (50), long 16,000c (43). This costs 93. It is cheap and almost zero-delta. A four session trend in either direction would lead to a strike and big profit. Even two big trending sessions could mean a profit in practice. A nearer-the money strangle is long 15500c (133), long 14500p (122) with a risk:reward ratio that is poorer than 1:1.

The Nifty call option chain for February has ample open interest (OI) between 7,400c and 8,000c with a big peak at 7,600c. The February put option chain has big OI peaks at 7,400p, 7,300p and 7,200p with a high OI until 6,800p. The February put-call ratio (PCR) is negative at 0.9 and the 3-month PCR is bearish at 0.82.

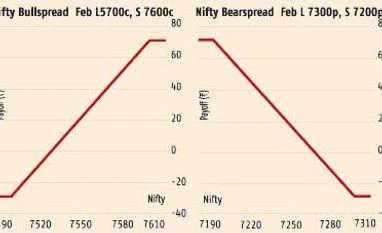

The Nifty closed at 7,387 on Monday. A bullspread of long Feb 7,500c (71), short 7,600c (39) would cost 32 and pay a maximum of 68 at about 113 points from spot. A bearspread of long 7300p (81), short 7,200c (53) costs 28 with maximum payoff of 72 and this is 87 points from spot. These spreads could be combined. But they are not zero-delta and the cost is higher than the potential payoff.

As of now, the consensus view for traders is bearish. If you want a two-way stance, the wider Bank Nifty strangle outlined above is a better bet.

The major trend still seems down. The Nifty reacted from a high of 7,600 on February 1. This is much lower than the prior high of 7,831 on January 5 and it maintains a bearish pattern of lower highs. However, lower lows have not yet been recorded in the latest downturn although we would expect lower lows if the major trend is down. The acid test would be a test of support at 7,250 and a fall below the current 52-low of 7,241 (January 20).

So, these are the points to watch for chartists. On the upside, look for a move beyond 7,600 setting up higher highs. On the downside, look for a fall below 7,240, for lower lows. The support at 7,200-7,250 looks fairly solid. As of Monday, the Nifty had bounced from support at 7,360. The bear market has lasted 11 months, with a correction from the all-time peak of 9,119 (March 2015).

A bounce till 7,750-7,850 levels could come quickly. The Nifty fell almost vertically from 7,800 to 7,250. One obvious trigger could be the possibility of strong rumours around the Budget, which drive the market up.

The Bank Nifty has run weaker than the overall market, which is unusual. As of now, most public-sector banks are near their respective 52-week lows and private banks have also seen selling on poor results. The Bank Nifty is just one big session away from a new 52-week low. A bearspread with an on-the-money long 15,000p (279), short 14,000p (51) costs 228. It could pay a maximum of 772. It would take just three or four big sessions to traverse 1,000 points.

An optimist hoping for bank sops in the Budget may try a long strangle, with a long 14,000p (50), long 16,000c (43). This costs 93. It is cheap and almost zero-delta. A four session trend in either direction would lead to a strike and big profit. Even two big trending sessions could mean a profit in practice. A nearer-the money strangle is long 15500c (133), long 14500p (122) with a risk:reward ratio that is poorer than 1:1.

The Nifty call option chain for February has ample open interest (OI) between 7,400c and 8,000c with a big peak at 7,600c. The February put option chain has big OI peaks at 7,400p, 7,300p and 7,200p with a high OI until 6,800p. The February put-call ratio (PCR) is negative at 0.9 and the 3-month PCR is bearish at 0.82.

The Nifty closed at 7,387 on Monday. A bullspread of long Feb 7,500c (71), short 7,600c (39) would cost 32 and pay a maximum of 68 at about 113 points from spot. A bearspread of long 7300p (81), short 7,200c (53) costs 28 with maximum payoff of 72 and this is 87 points from spot. These spreads could be combined. But they are not zero-delta and the cost is higher than the potential payoff.

As of now, the consensus view for traders is bearish. If you want a two-way stance, the wider Bank Nifty strangle outlined above is a better bet.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 08 2016 | 10:41 PM IST