How Kuoni fell behind in the travel trade

The Swiss company's problems in India were because of its technological inability to cater to the changing nature of holidays that has altered the DNA of the industry

)

Kuoni Travel, a top tour operator headquartered in Switzerland, announced last week that it had decided to divest its tour-operating activities in many countries, including India. The company had entered India through a strategic 51 per cent stake in SOTC Holiday Tours Private a little less than two decades ago.

Announcing the exit, the company said in a statement that "in spite of this position [of being a leading tour operator with a global presence], Kuoni's outbound business faces increasing challenges from changing market conditions." According to its website, the company has decided to focus on its core business as a service provider to the global travel industry and to governments.

It is not the first time that a travel company has decided to quit India. Earlier, Thomas Cook had exited its India business after selling its local unit to Fairfax Holdings. In fact, there has been a steady decline in the fortunes of innumerable brick and mortar, or offline, tour-operating companies in the last half a decade or so.

Even as Kuoni did not reply to a questionnaire emailed to it by Business Standard, the company is believed to have requested leading tour-operators to be discreet about giving out any information on the divestment. However, industry analysts and a few heads of well-known tour-operating companies did comment after requesting anonymity. One such person remarked, "A tectonic development, but not too shocking."

Kuoni's exit hasn't taken analysts by surprise. While big in its own right, Kuoni did not have any unique and definitive products, nor did it cater to a niche market, says one analyst. "Unless you have a definitive identity in the market, you are bound to be mired in problems," is his explanation for Kuoni's performance.

The problem for tour companies lies in the slow pace of growth in the sector. "While domestic and outbound markets have mushroomed, inbound traffic has plateaued," says Hari Nair, founder & CEO, HolidayIQ, a leading travel and holiday information portal. "If business travellers and NRIs are taken out of the equation, the growth rate is perhaps negative. Inbound leisure travel has hardly grown."

Nair's analysis is backed by data. In the past three years, foreign tourist arrivals, or FTAs, as they are called in the business, have grown grudgingly - from 6.3 million in 2011 to 6.5 million in 2012 and 6.9 million in 2013. The foreign exchange earnings in the same three-year period rose 7.1 per cent from $16.5 billion in 2011 to $17.73 billion in 2012 and then 4 per cent to $18.44 billion in 2013. India today ranks 42nd in World Tourist Arrivals and accounts for a share of a mere 0.64 per cent in International Tourist Arrivals.

Of course, the figures are different in the domestic and outbound travel segments. While the number of domestic visits to all states and union territories was 864.53 million in 2011, it climbed 20.9 per cent to 1.04 billion in 2012 and a further 9.6 per cent to touch 1.15 billion in 2013. Similarly, outbound travel, which was 16.63 million in 2013, saw a 11.4 per cent jump from 14.92 million departures in 2012 and 13.99 million in 2011.

The change in story

Kuoni's decision leads to the question of why brick and mortar companies are exiting the space. The answer, in part, lies in the fragmentation of the travel market due to a change in something as fundamental as the medium of social engagement. Or, as Sharat Dhall, president of Yatra, a popular travel portal, puts it succinctly: "The Internet."

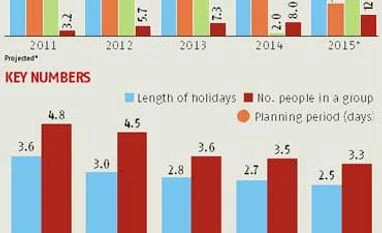

As Online Travel Agencies (OTAs) like Yatra, TripAdvisor, Expedia, MakeMyTrip and others have taken a big chunk of the traditional business from travel companies, there have been corresponding changes in the nature of holidays, the type and age group of travellers, the duration of holidays and the lowering of international air fares. These have altered the DNA of the travel industry.

And while the OTAs have captured a large share of the market, it is also true that the overall market size has grown, leaving many unanswered questions about why the fortunes of tour operators have declined. "It is possible that offline stores have not been able to scale at the rate of OTAs," says Dhall. "Tour operators were people who knew what they were doing, people who could give you a good experience. However, with the volume of content, customisation and choices available online today, offline models capitulated first." (See Travel tales)

"Brick-and-mortar companies are limited in their scope, so their ability to scale is restricted as well," explains Subhash Goyal, chairman, STIC Travels. "OTAs have scaled massively, abetted by the growing Internet penetration and rise in disposable income." Nair believes this inability of tour operators to adapt to changes is an important reason why brick and mortar stores find themselves in a quandary. "Most of what these companies offer tends towards long-haul holidays involving long flights, group tours, packages, the works," he points out. "However, a greater chunk of holidays today are extended weekends and short-haul holidays. The value proposition from offline stores for smaller trips hasn't been able to keep up with the paradigm shift in the nature of demand."

In spite of dominating the market, OTAs have thin margins but get by happily because of the volumes generated. Offline operators with limited online presence, on the other hand, have bigger margins but diminishing market share. "That is an ever-present dichotomy," explains the head of a well-known tour-operating body. "While we are in this game for dividends, OTAs are in it for valuation."

Offline tour operators get 30-40 per cent of their calls after redirection from their presence in the online space, but the conversion rate into actual purchases from such enquiries is less than 5 per cent, say industry analysts. OTAs too have offline stores, but these contribute less than 20 per cent to their revenues. The offline presence is "mostly for visibility and to sell packaged tours, which is not our core business", according to Dhall.

However, no one argues that it is the end for offline companies. "OTAs will become bigger players," says Goyal, "but brick and mortar stores will continue to sustain and prosper." He compares buying a tour package from an online store with buying medicine on the Net, and says, "Human proximity is imperative for such decisions. That is is our core strength and not of OTAs."

The head of another popular tour company agrees. He says the future will also belong to those offline tour operators that identify their strengths and offer experiential, customised holidays. "Anything less than that and you'll be losing out on revenues sooner than later, like Kuoni," he says. This sums up the situation for travel companies pretty well: adapt or be vanquished.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 27 2015 | 12:25 AM IST