Sustainable turnaround still elusive, say CEOs

Another study urges the govt to 'walk the talk' and take steps to improve ease of doing business

)

Investments, profits and exports lack a 'sustainable turnaround', according to the results of a business confidence survey released on Tuesday. Another study urged the government to 'walk the talk' and take steps to improve ease of doing business.

The results of the Business Confidence Survey by the Federation of Indian Chambers of Commerce and Industry (Ficci) showed a marginal dip in the proportion of respondents anticipating 'moderately to substantially better' performance over the near-term at economy, industry and company level.

Read our full coverage on Union Budget

While the situation was better than last year, the change in quarter-on-quarter numbers were yet to indicate a firm turnaround, Ficci said. According to Ficci's poll, measures announced by the government over the past seven-eight months have had a positive impact on the sentiment of the business community.

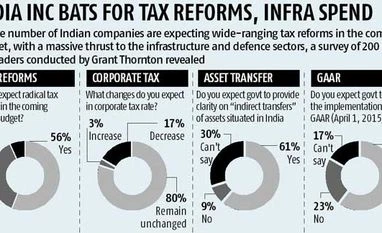

In another survey, consultancy major Grant Thornton said half the Indian businesses expect radical tax reforms and more clarity on certain taxation measures in the Budget. "There is political stability, markets are at a high, everyone is talking about acche din. The Prime Minister has spoken about 'Make in India'. He has stressed on our desire to attract foreign direct investment and has reassured global investors a non-adversarial tax environment, but India still ranks 142 out of 189 countries in the ease of doing business," said Pallavi Bakhru, director Grant Thornton Advisory. "Now is the opportunity for the government to walk the talk. India Inc is waiting with bated breath!," Bakhru added.

Yet another survey by the Confederation of Indian Industry (CII) found the industry pinning high hopes on the Narendra Modi-led government's first full Budge.

According to Ficci and CII surveys, most CEOs believe a framework for the goods and services tax would be announced in the Budget, which would tilt the balance in the interest of revenue neutrality.

Besides, India Inc wants finance minister Arun Jaitley to simplify taxes and step up action on ease of doing business. Most CEOs polled by the CII expect the revenue-deficit target for the coming year to be between 2.6 per cent and 2.8 per cent of the GDP, while they believe the fiscal deficit will be set between 3.7 per cent and four per cent of the GDP.

The participants in the surveys said they were also looking forward to labour reforms and incentives for sectors including manufacturing, infrastructure and real estate.

According to CEOs who participated in the CII survey, sustained GDP growth is essential for tax revenue buoyancy, and growth recovery needs a capex stimulus.

Capital expenditure was budgeted at Rs 2.3 lakh crore in FY15 and is still falling short. Most CEOs polled believe an increase in capital expenditure outlay in FY16 will be budgeted at Rs 70,000 crore.

To fund this capex, they suggest apart from subsidy rationalisation, revenues can be augmented through aggressive disinvestment of government holdings in public sector enterprises.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 25 2015 | 12:28 AM IST