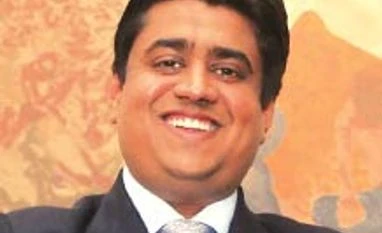

Masala loans will have more takers than masala bonds: Amit Bordia

Interview with head of Corporate Finance India

)

The initial success of masala bonds, or rupee-denominated bonds issued in the foreign market, has prompted Indian companies to explore if they could raise rupee loans from abroad. Deutsche Bank is helping these companies raise such loans, said Amit Bordia, head of Corporate Finance India, in an interview with Anup Roy. Edited excerpts:

How is the international market looking for Indian firms?

We are energised to see that international debt markets have completely opened their doors to Indian firms and their issuances. In the international markets, Indian firms have all three things going for them — abundant liquidity, tremendous yield differential, and an excitement around the India story. Strong businesses are driving some really good price outcomes even for very large sized offerings. I have never seen such a positive environment for Indian corporates’ issuances in terms of hard currency. Of course, this will not last forever.

Is the enthusiasm there for highly rated companies?

This is across sectors, place and reasons. Companies could be refinancing existing debt, raising capital for acquisitions or organic growth capital. Issuers with investment grade and sub-investment grade ratings are looking at offshore capital for their initiatives. Pricing in high-yield bonds are at historic lows. Now, issuers are even looking at a 10-year horizon, a first for Indian firms in the high-yield market. Earlier, the maximum tenor investors would look at was five to seven years of maturity. The high-yield market will see at least 50 per cent first time issuers from India.

Also Read

Will a rate hike by the US Federal Reserve change the dynamics?

The yield differential will start rebalancing as we go from a rate cut cycle and the US goes through a rate hike cycle. At some stage, markets will stop being so benign.

How is the masala bond market shaping up?

Investors in masala bonds are EM (emerging markets) local currency funds, not traditional EM high-yield dollar funds. This pool of liquidity is relatively small. For a lot of the traditional high-yield investors, masala bonds are not attractive as they have to carry the FX risk along with credit risk.

The initial success in the masala bonds market was largely around high profile issuers, where the market was anyway participating through the foreign portfolio investor route. It is a fantastic instrument, but it will take time for the market to open up as investors get more convinced that Indian rupee is relatively more stable and has a consistent forward trajectory that can be priced in. ýI have no doubt that masala will be the flavor of the market in times to come.

What new modes of financing are emerging?

We are now looking at masala loans, or the INR ECBs. It’s the same as masala bonds, where the loan investor takes the currency risk. In my view, the local currency loan space is likely to have more appetite than Masala bond space for mid-tier borrowers. Therefore, masala loan market will have significant appeal and depth. These loans are going to be an interesting vehicle.

How are companies in India approaching the international market?

If you look at the multinationals, companies that have significant presence in India now want local entities to be financially more self-sustainable and are slowly behaving like local corporates. They are tapping the local bond and loan markets and even do high-yield bond issuance out of their Indian entity.

If you look at the multinationals, companies that have significant presence in India now want local entities to be financially more self-sustainable and are slowly behaving like local corporates. They are tapping the local bond and loan markets and even do high-yield bond issuance out of their Indian entity.

Many companies in investment heavy sectors had borrowed heavily to fund their growth, but are struggling with the down cycle. And we are working closely with those companies and their lending banks to offer them financing solutions that involve collateralised asset or cash flow-based financing. In some cases, Indian entities are not doing well, but their offshore subsidiaries, often acquired, are doing very well. Those offshore units can be leveraged more efficiently. On the other hand, there are corporates doing very well, don’t have stress, and operate in cash accretive businesses. Players in these sectors, such as in pharma, IT services/e-commerce and telecom, are hungry for growth and are looking at acquisition finances in the foreign market.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 25 2016 | 10:07 PM IST