Cement sector's earnings at risk in Q4 FY16

Low rural incomes, weak demand force companies to hold prices

)

Cement producers are expected to exit FY15 on a weak note. They have not increased prices in the March quarter, despite an increase in freight rates, as demand remained weak. Demand halved in the December quarter compared to the first half of the financial year, as rural incomes weakened and the government spent less on schemes. This is rather unusual, as producers tend to increase prices in March, when demand picks up.

Other than the southern and central regions, demand and price remained weak. While demand rose 9.7 per cent over a year in the first six months of the financial year, the third quarter saw demand grow 4.5 per cent. The all-India average price is up only two per cent over a year but down three per cent month-on-month, say analysts.

Announcements in the Union Budget have made coal, freight and diesel more expensive but cement producers have not announced any price rise so far, other than a few in Maharashtra and Rajasthan. Emkay Global says prices are witnessing deep pressure in the north and central regions, where the average was down 16 per cent/14 per cent over a year in February. Instead of increasing in the fourth quarter, prices have dropped, a big concern.

With prices staying put, earnings assumptions for FY16 are at risk. According to IIFL Institutional Equities, if the February trend for demand and prices continues into March, the exit price for FY15 could be substantially lower than the consensus expectation, which puts FY16 estimates at a huge downward risk. The risk to earnings growth might persist for the next two to three quarters, say analysts, till demand recovers and producers are able to pass on higher costs to consumers.

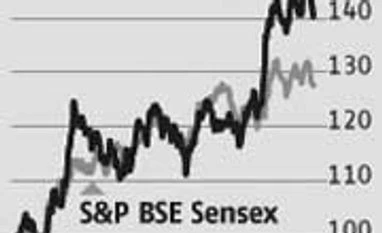

Despite the risk to earnings in the near term, analysts remain positive on the sector for several reasons. At 11-13 times earnings, the sector is valued fairly. Additionally, the sector tends to command premium valuation compared to the market when demand picks up and operating margins expand.

Morgan Stanley believes the sector is at the cusp of a cyclical recovery. The global brokerage believes with eight per cent demand growth (against nine per cent earlier) and five per cent compound annual growth in over F15-17, capacity, utilisation could improve to 84 per cent in F17, compared with 78 per cent in F15, driving a 600 basis points earnings before interest, taxes, depreciation and amortisation margin gain. While near-term earnings estimates are moderating, the long-term story remains strong.

Other than the southern and central regions, demand and price remained weak. While demand rose 9.7 per cent over a year in the first six months of the financial year, the third quarter saw demand grow 4.5 per cent. The all-India average price is up only two per cent over a year but down three per cent month-on-month, say analysts.

Announcements in the Union Budget have made coal, freight and diesel more expensive but cement producers have not announced any price rise so far, other than a few in Maharashtra and Rajasthan. Emkay Global says prices are witnessing deep pressure in the north and central regions, where the average was down 16 per cent/14 per cent over a year in February. Instead of increasing in the fourth quarter, prices have dropped, a big concern.

Despite the risk to earnings in the near term, analysts remain positive on the sector for several reasons. At 11-13 times earnings, the sector is valued fairly. Additionally, the sector tends to command premium valuation compared to the market when demand picks up and operating margins expand.

Morgan Stanley believes the sector is at the cusp of a cyclical recovery. The global brokerage believes with eight per cent demand growth (against nine per cent earlier) and five per cent compound annual growth in over F15-17, capacity, utilisation could improve to 84 per cent in F17, compared with 78 per cent in F15, driving a 600 basis points earnings before interest, taxes, depreciation and amortisation margin gain. While near-term earnings estimates are moderating, the long-term story remains strong.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 11 2015 | 9:36 PM IST