Bankruptcy proposals must address existing shortages: experts

Final law won't be effective till already-overworked adjudicating authorities are provided with additional resources, say experts

)

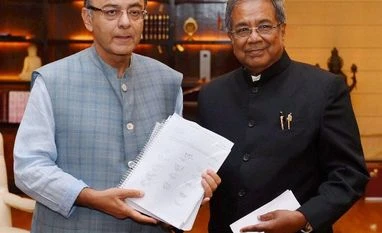

Chairman of the Bankruptcy Law Reforms Committee (BLRC), T K Viswanathan presenting report to the Union Minister for Finance, Corporate Affairs and Information & Broadcasting, Arun Jaitley, in New Delhi

The bankruptcy law report and draft legislation given to the government on Wednesday is a timely exercise, seeking to do away with multiple jurisdictions and the existing gamut of laws to deal with insolvencies, analysts and experts told Business Standard. However, the final law won’t be effective till the legal options are strengthened further and additional resources put into the already overworked adjudicating authorities, they said.

The Bankruptcy Law Reforms Committee, headed by former Lok Sabha secretary-general T K Vishwanathan, has recommended a six to a maximum of nine months to deal with insolvency and enable winding-up of operations of a company or a limited liability entity. Their draft law has also proposed early identification of financial distress, so that steps can be taken to revive an ailing company.

The draft also consolidates the existing laws on insolvency of companies, limited liability entities, unlimited liability partnerships and individuals. These are presently scattered among a number of legislations. “It definitely looks like a good move. Right now, there are multiple jurisdictions and several laws dealing with insolvencies. You have situations where creditors approach multiple forums with their grievances and promoters seek unlimited stay to the proceedings,” said Mrityunjay Kapur, partner and head of risk consulting and strategy, KPMG in India.

Also Read

Adding: “There is a need for clear law, which consolidates all the existing provisions from various legislations and removes the bottlenecks and loopholes. We have to wait for the final version of the bankruptcy bill but it looks like a comprehensive effort, which addresses a lot of issues.”

India has three different laws on insolvency, for various entities, and four regulatory agencies with overlapping jurisdiction. “Having a unified structured and robust bankruptcy law will protect the rights of borrowers and lenders, clarify the risks associated with lending, foster predictability, and make debt collection through insolvency proceedings more certain, thereby facilitating credit lending, leading to an increase in the flow of capital in the economy,” said Rohit Mahajan, partner and head of forensic & financial advisory, Deloitte in India.

“Having a legislative framework and mechanism to deal with insolvency and difficult financial situations has been a long-pending demand of industry and the investor community. This will also help to change our attitude towards honest failures,” said Nishith Desai, managing partner, Nishith Desai Associates.

The draft Bill recommends the existing Debt Recovery Tribunals be the adjudicating authority for individuals and unlimited liability partnership firms. And, that the National Company Law Tribunal be the one for companies and limited liability entities. It also proposes setting up of information utilities, to collect and collate financial information from listed companies and their creditors. “An individual insolvency database is also proposed to be set up, with the goal of providing information on insolvency status of individuals.”

Experts say the proposal of only two tribunals as adjudicators is excellent but both are overburdened and understaffed. “It is for the government to ensure that the necessary infrastructure is created for these two tribunals, as well as the support system for bankruptcy cases. There is a need for additional manpower and resources. We will need more lawyers and insolvency experts,” said KPMG’s Kapur.

“Effective implementation of a bankruptcy code requires administrators, judiciary and businesses to put together processes and practices, where speed would be of essence,” Nishith Desai added.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 06 2015 | 12:43 AM IST