ITC Q2 Preview: Modest cigarette growth to drag topline

Analysts are expecting its tobacco business to grow 2-3 per cent in Q2

)

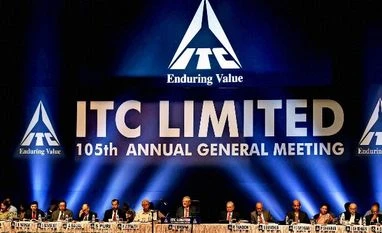

ITC Chairman Y C Deveshwar addresses shareholders in the presence of other board members during 105th Annual General Meeting of the Company

Amidst weak demand in the fast moving consumer goods space (FMCG) and the ongoing stress in the cigarettes industry, cigarettes-to-FMCG major ITC is expected to see its topline grow modestly.

Analysts are expecting its tobacco business to grow 2-3 per cent in Q2.

“On a base of 16 per cent year-on-year decline, we expect volume growth of three per cent year-on-year in Q2FY17 in cigarettes”, an analyst at Edelweiss Securities said. The first quarter of the current financial year, according to the analyst saw a three per cent volume growth on a base of 17 per cent decline in volumes.

In Q1, the revenue share from the cigarette business declined by one per cent in the quarter to touch Rs 8,231 crore, up 6.4 per cent year-on-year, against Rs 7,733 crore in the corresponding quarter of the past financial year.

Motilal Oswal is expecting a lower volume growth in the tobacco business.

Also Read

“We expect cigarette EBIT to grow 8.9 per cent year-on-year. We have factored in EBITDA growth of 10.4 per cet year-on-year to Rs. 3,930 crore”, a report from Motilal Oswal said.

Nomura, however, is expecting the cigarette business to exceed the suggestions put up by other brokerage reports and expects ITC to post an eight per cent revenue growth for the cigarettes business, with volume growth of four per cent on a low base.

“We do not expect the FMCG business to be EBIT positive this quarter given the aggressive pricing”, a report from Nomura said.

In the past four years, the incidence of excise duty and value added tax on cigarettes, at a per unit level, has gone up cumulatively by 118 per cent and 142 per cent, respectively, which in turn, exerted severe pressure on the sector.

Kotak Securities, which is also expecting the cigarette business to stall a bit said that tobacco sales will affect revenue growth. It expects the company to post a rise of five per cent on a year-on-year basis in its total revenue for Q2.

In Q1, ITC’s FMCG segment grew by 9.5 per cent amidst weak demand and deflationary price, particularly in the personal care business, while its loss before interest and tax declined to Rs 4.5 crore against Rs 8 crore in the year ago period.

According to Edelwiess Securities, in FMCG, soaps could see muted numbers given rebalancing by consumer due to price hikes. Subdued demand in hotels and papers is expected to continue.

“Margins are likely to decline on the back of higher employee expenses and higher salience of agri-business. We estimate per cent growth in profit for the company”, a report from Kotak Securities stated.

According to an analyst with SBI Cap, ITC’s cigarette division is expected to report an EBIT growth of eight per cent with sales growth of seven per cent, led by four per cent increase in cigarette volumes and three per cent growth in net pricing. Better performance of the FMCG division and ari-business is likely to drive 10 per cent earnings growth.

In Q1, the share of income from the agri business to ITC’s total revenue rose by two per cent at Rs 2,794 crore, against Rs 2,325 crore in the first quarter of the last financial year.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 25 2016 | 12:28 PM IST