Deferment of new price deflates gas producers' hopes

UPA govt asked the EC if the increasing gas prices from April 1 would violate its model code of conduct

)

Hours after the Election Commission on Monday asked the government to postpone the planned increase in domestically-produced natural gas from April 1 to after the general elections, disbelief was writ large on the face of a hydrocarbon industry leader. "This is indeed a banana republic," he said. In a little over a week, the price of natural gas was set to almost double to $8.2 per million metric British thermal unit, or mmBtu, from $4.2 per mmBtu.

With elections and the counting of results slated to get over by mid-May, and the ensuing political permutations and combinations, he is apprehensive that it could be several months before the prices actually increase - that is, if the new government has the political courage to do it. If the Aam Aadmi Party, which has made this a huge election issue, comes to power, the future could look murkier. At least one quarter of improved earnings can be kissed goodbye, the man reckons.

It was Planning Commission Deputy Chairman Montek Singh Ahluwalia who first came forward with the idea that the government should approach the Election Commission on the decision, though it had been cleared by the Cabinet way in advance. To add fuel to the fire, Arvind Kejriwal, the convener of the Aam Aadmi Party, too, wrote to the Election Commission on the matter. This ultimately led to Monday's decision which has caused much heartburn in the sector.

Naturally, the hydrocarbon industry believes it has got the rough end of the stick. The United Progressive Alliance government asked the Election Commission if the increasing gas prices from April 1 would violate its model code of conduct. The industry thinks this was a grave mistake since the decision was taken much earlier. The Cabinet Committee on Economic Affairs had cleared the proposal to increase the price of domestic natural gas based on a formula suggested by C Rangarajan, the chairman of the Prime Minister's Economic Advisory Council, on June 27, 2013. According to the Rangarajan formula, the prices were supposed to increase to at least $8.2 per mmBtu from the current $4.2 per mmBtu from April 1. On the other hand, the election dates -from April 7 to May 16 - were announced only on March 5 this year.

While the merits of the referral will be discussed for many more days, one thing is clear: there will be a severe impact on the projected cash flows and cap-ex plans of companies such as Reliance Industries, ONGC and OIL India. "This is frustrating. The government saw it as a convenient way to save face," says RS Sharma, the head of the hydrocarbon committee of the Federation of Indian Chambers of Commerce & Industry and former chairman of ONGC. In fact, the talk is gaining currency that by referring the matter to the Election Commission, the government has tried to take the wind out of Kejriwal's campaign against it. Sharma fears that the price increase may now be put on the back burner. "The new government is unlikely to take such a decision during its initial months, which means the industry may have to wait for several months to see a price increase," says he.

The companies that have got impacted are busy calculating their losses. According to industry estimates, the near-doubling of gas prices would have added Rs 12,000 crore to ONGC's revenue every year, given its output of 60 mmscmd (million metric standard cubic metres per day). "Our net profit would have zoomed at least Rs 2,300 crore for every one dollar increase in price. The decision to defer it is actually a step backwards," says ONGC Director (finance) AK Banerjee. The higher price would have increased OIL's annual revenue by Rs 1,500 crore (on 8 mmscmd production) and that of Reliance Industries by Rs 3,000 crore (13.11 mmscmd). Moreover, it would have added another Rs 13,500 crore to the government's kitty in the form of petroleum profit.

Analysts, naturally, are less than enthused. "This is a near-term negative, as the merit of a gas price increase is still warranted, but resistance in some parts of the government has resulted in the current verdict. There is no mention as of now on the implementation of the new gas price at a later date and/or any retrospective element associated with it. Hence, this has led to an uncertainty in the sector," says Dhaval Joshi of Emkay Global Financial Services. The Reliance and ONGC stocks fell 2.87 per cent and 0.34 per cent, respectively, on BSE on Tuesday.

The user groups, meanwhile, have reason to cheer. Had the gas price been increased by $4 per unit, the fuel cost of fertiliser producers would have shot up by Rs 9,300 crore and power producers by Rs 7,200 crore. This was sure to have implications on the gas sale-purchase agreements to be signed between 16 consumers and Reliance Industries for the KG-D6 gas. The current contracts for gas supply were getting over on March 31. Both the company and the consumers are quarrelling over the terms and conditions of the new draft agreement right now. "Gas is a pass-through for us. However, the decision will save an increase in subsidy burden at least for a quarter," says Satish Chander, director general of the Fertiliser Association of India.

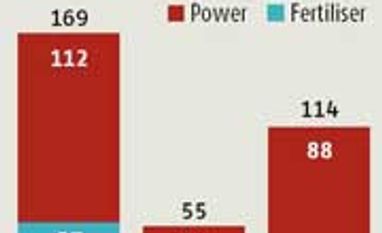

Countering the allegations of the Aam Aadmi Party and Left leader Gurudas Dasgupta (he has filed a public interest litigation in the Supreme Court), Mukesh Ambani-led Reliance Industries says, "The country may lose more than Rs 120,000 crore per annum if the gas prices are not raised, as import dependency would increase." It is expected that the demand from the fertiliser and power sectors will rise to 55 mmscmd (from 31 mmscmd now) and 112 mmscmd (24 mmscmd), respectively, by 2015-16. "The price of LNG import in the country today is $14-19 per mmBtu. At $14, the cost of LNG import to meet the gas demand of the core sector would be Rs 120,000 crore per year," a background note prepared by Reliance Industries adds.

ONGC's new chairman, DK Sarraf, too has hinted that its biggest discovery in the Krishna-Godavari basin may not be viable at even $8 per mmBtu.

With elections and the counting of results slated to get over by mid-May, and the ensuing political permutations and combinations, he is apprehensive that it could be several months before the prices actually increase - that is, if the new government has the political courage to do it. If the Aam Aadmi Party, which has made this a huge election issue, comes to power, the future could look murkier. At least one quarter of improved earnings can be kissed goodbye, the man reckons.

It was Planning Commission Deputy Chairman Montek Singh Ahluwalia who first came forward with the idea that the government should approach the Election Commission on the decision, though it had been cleared by the Cabinet way in advance. To add fuel to the fire, Arvind Kejriwal, the convener of the Aam Aadmi Party, too, wrote to the Election Commission on the matter. This ultimately led to Monday's decision which has caused much heartburn in the sector.

Naturally, the hydrocarbon industry believes it has got the rough end of the stick. The United Progressive Alliance government asked the Election Commission if the increasing gas prices from April 1 would violate its model code of conduct. The industry thinks this was a grave mistake since the decision was taken much earlier. The Cabinet Committee on Economic Affairs had cleared the proposal to increase the price of domestic natural gas based on a formula suggested by C Rangarajan, the chairman of the Prime Minister's Economic Advisory Council, on June 27, 2013. According to the Rangarajan formula, the prices were supposed to increase to at least $8.2 per mmBtu from the current $4.2 per mmBtu from April 1. On the other hand, the election dates -from April 7 to May 16 - were announced only on March 5 this year.

While the merits of the referral will be discussed for many more days, one thing is clear: there will be a severe impact on the projected cash flows and cap-ex plans of companies such as Reliance Industries, ONGC and OIL India. "This is frustrating. The government saw it as a convenient way to save face," says RS Sharma, the head of the hydrocarbon committee of the Federation of Indian Chambers of Commerce & Industry and former chairman of ONGC. In fact, the talk is gaining currency that by referring the matter to the Election Commission, the government has tried to take the wind out of Kejriwal's campaign against it. Sharma fears that the price increase may now be put on the back burner. "The new government is unlikely to take such a decision during its initial months, which means the industry may have to wait for several months to see a price increase," says he.

Analysts, naturally, are less than enthused. "This is a near-term negative, as the merit of a gas price increase is still warranted, but resistance in some parts of the government has resulted in the current verdict. There is no mention as of now on the implementation of the new gas price at a later date and/or any retrospective element associated with it. Hence, this has led to an uncertainty in the sector," says Dhaval Joshi of Emkay Global Financial Services. The Reliance and ONGC stocks fell 2.87 per cent and 0.34 per cent, respectively, on BSE on Tuesday.

The user groups, meanwhile, have reason to cheer. Had the gas price been increased by $4 per unit, the fuel cost of fertiliser producers would have shot up by Rs 9,300 crore and power producers by Rs 7,200 crore. This was sure to have implications on the gas sale-purchase agreements to be signed between 16 consumers and Reliance Industries for the KG-D6 gas. The current contracts for gas supply were getting over on March 31. Both the company and the consumers are quarrelling over the terms and conditions of the new draft agreement right now. "Gas is a pass-through for us. However, the decision will save an increase in subsidy burden at least for a quarter," says Satish Chander, director general of the Fertiliser Association of India.

Countering the allegations of the Aam Aadmi Party and Left leader Gurudas Dasgupta (he has filed a public interest litigation in the Supreme Court), Mukesh Ambani-led Reliance Industries says, "The country may lose more than Rs 120,000 crore per annum if the gas prices are not raised, as import dependency would increase." It is expected that the demand from the fertiliser and power sectors will rise to 55 mmscmd (from 31 mmscmd now) and 112 mmscmd (24 mmscmd), respectively, by 2015-16. "The price of LNG import in the country today is $14-19 per mmBtu. At $14, the cost of LNG import to meet the gas demand of the core sector would be Rs 120,000 crore per year," a background note prepared by Reliance Industries adds.

ONGC's new chairman, DK Sarraf, too has hinted that its biggest discovery in the Krishna-Godavari basin may not be viable at even $8 per mmBtu.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 25 2014 | 11:14 PM IST