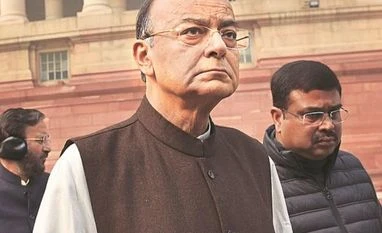

IL&FS' board, stakeholders to deal with debt crisis: FM Arun Jaitley

LIC is the largest shareholder in IL&FS with a 25.34% stake while the state-owned State Bank of India has a 6.42% stake

)

The government is confident of meeting all capital expenditure targets… We might exceed disinvestment target this fiscal year: Arun Jaitley, Union finance minister

Finance Minister Arun Jaitley on Monday said that the IL&FS' board and its stakeholders will deal with the debt crisis facing the company.

When asked about the IL&FS issue, Jaitley said: "I am not making any comments on this. Let their board and stakeholders deal with the matter."

Jaitley was responding to reporters' queries on reports appearing earlier on Monday which said that the Finance Ministry was approached after the IL&FS' key stakeholder, the state-run Life Insurance Corporation and others rejected a Rs 30 billion loan facility.

According to these reports, the company requires this amount to avert default on its Commercial Paper (CP) obligations and a ratings downgrade.

LIC is the largest shareholder in IL&FS with a 25.34 per cent stake while the state-owned State Bank of India has a 6.42 per cent stake.

Also Read

The two financial institutions are, in turn, under the supervision of the Department of Financial Services (DFS).

The reports, however, said that the Ministry has taken an adverse view of the proposal by IL&FS to stave-off the looming debt crisis.

As part of its fund-raising plans, the company's board had, on August 29, approved a Rights Issue of 300 million equity shares at Rs 150 per share aggregating to Rs 45 billion to shore up its capital. The process would be completed by October 30, the company had said in a statement earlier.

"As on March 31, 2018, IL&FS net worth was Rs 74 billion. In addition, the Board approved the re-capitalization of group companies to the extent of Rs 50 billion in IL&FS Financial Services, IL&FS Transportation, IL&FS Energy, IL&FS Environment, and IL&FS Education," the company said.

"The Board also approved the Company's specific asset divestment plan based on which IL&FS expects to reduce its overall debt by Rs 300 billion. Out of a portfolio of 25 projects identified for sale, firm offers have already been received for 14 projects."

The August 29 statement had also said that the company expects to complete its divestment plan over the next 12 to 18 months in a systematic and professional way to fulfil its commitments.

The group has around Rs 1 trillion worth of debt on its books.

IL&FS companies form an ecosystem of expertise across infrastructure, finance and social and environmental services

Initially promoted by the Central Bank of India, Housing Development Finance Corporation Limited and Unit Trust of India, IL&FS was incorporated in 1987.

Over the years, it has inducted institutional shareholders including SBI, LIC, ORIX Corporation of Japan, and Abu Dhabi Investment Authority (ADIA).

As on March 31, 2018, LIC and ORIX Corporation are the largest shareholders in IL&FS with their stake holding at 25.34 per cent and 23.54 per cent respectively. Other prominent shareholders include ADIA (12.56 per cent stake), HDFC (9.02 per cent stake), CBI and (7.67 per cent stake) and SBI (6.42 per cent stake).

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 17 2018 | 7:54 PM IST